The Sagix Compound in practice: December 2025 portfolio review

December 2025 portfolio review: real positions, zero sales, only sacred buying. Six-layer barbell structure designed for 2036, 2046, 2056—not getting rich quick in 2026. See exactly how we practice what we preach.

Real positions, zero sales, only sacred buying. Here's exactly how we build wealth while the hares self-destruct.

In a world where crypto Twitter screams about 100x plays and DeFi influencers chase unsustainable yields, we do something radical: we publish our actual portfolio. Not a theoretical model. Not a backtest. Real positions held by real people who plan to still be wealthy in 2036, 2046, and 2056.

This is The Sagix Compound—our portfolio construction philosophy applied to actual capital.

Why we're showing you this

Most financial content creators hide behind abstract advice while their own portfolios tell different stories. We believe in radical transparency. If our philosophy is sound, our portfolio should prove it. If we preach survival over optimization, our positions should reflect that. If we warn against concentration risk, our holdings should demonstrate diversification.

So here it is—every position, every layer, every principle made visible of what we do ourselves.

Of course, there are many valid implementations of a similar philosophy. One could argue that holding SPY alongside QQQ produces great results over time. We totally agree. Investing is a journey, and each person has to find what they're comfortable with. The specific assets we hold all carry their own risks, and this portfolio is not immune to drawdowns.

The point is to understand and believe in a thesis for each asset, so when the storm comes, we stick to our convictions—knowing that eventually the sun will shine again, and we won't get rekt.

The barbell structure: Why our tortoise outlives the hares 🐢

Our portfolio follows a barbell architecture that we call The Sagix Compound. It's named for what it does: compounds wealth across decades through a carefully balanced structure.

Layer I – The anchor (~18%)

Bonds + money market funds and a dash of gold

This is the oxygen. When crypto crashes 70%, when markets panic, when the hares get liquidated—we have dry powder. This layer serves one purpose: ensuring we're buyers during chaos, not forced sellers.

The psychology matters as much as the mathematics. Knowing you have 18% in truly safe assets lets you hold your growth positions through volatility instead of panic-selling at bottoms. Most portfolios fail not from poor selection but from forced liquidation at exactly the wrong moment.

Layer II – Defensive ballast & income (~17%)

This is the core that never goes to zero. Quality businesses that humanity needs regardless of economic cycles:

Regulated utilities: Duke Energy, Southern Company, Waste Management—people pay their electric bills in recessions.

Inevitable healthcare: Johnson & Johnson, Merck, AbbVie, Pfizer—demographic destiny favors these businesses for decades.

Essential consumption & staples: PepsiCo, Procter & Gamble, Coca-Cola, Clorox, General Mills, Hormel Foods, Colgate-Palmolive, Carter's—products purchased during booms and busts alike.

Business services that never get cut: Paychex, Automatic Data Processing—payroll processing is literally the last expense a company eliminates.

Insurance & specialty: Aflac, WD-40—boring businesses with exceptional durability.

Entertainment families never cut: Disney, Netflix—even in recessions, parents find money for their children's happiness.

Layer III – Tax-efficient international income (~10%)

Irish-domiciled dividend ETFs: IUHC, IUES, VUAA, VPN, UKRE, MMLP, IUKP, GLDV, WENE, IUSP, UDVD, IDUS

These funds provide diversified exposure to global dividend-paying equities through tax-efficient structures. The Irish domicile offers advantages for non-US investors, reducing withholding tax drag on dividend income. This layer compounds quietly in the background—no drama, just accumulating income from hundreds of quality companies worldwide.

Layer IV – Real estate & tangible assets (~12%)

Real property generating real income—assets you can touch, with leases that produce predictable cash flows:

Triple-net REITs: NNN REIT, Realty Income, WP Carey—tenants pay property taxes, insurance, and maintenance while we collect rent.

Healthcare real estate: Healthpeak Properties, Alexandria Real Estate—demographic tailwinds from aging populations and biotech expansion.

Retail & mixed-use: Kimco Realty, Simon Property Group, Federal Realty—prime locations with irreplaceable real estate.

Storage & specialty: Public Storage—recession-resistant demand as people always need to store their stuff.

Alternative income: Main Street Capital—middle-market lending with equity upside.

This layer provides inflation protection through real assets, income streams that often grow faster than inflation, and genuine diversification from both stocks and bonds.

Layer V – Quality growth engine (~35%)

These are businesses built to dominate for decades:

Technology infrastructure: Microsoft, Apple, Google, Adobe, Cisco, NVIDIA—the digital rails everything runs on. Plus smaller positions in Tesla for AI and robotics growth optionality—sized appropriately because volatility isn't risk when the position can't hurt you.

Financial infrastructure: JPMorgan, BlackRock, Visa, US Bancorp—the plumbing of global finance.

Essential enterprises: Exxon Mobil (cash flow machine), Rollins (pest control monopoly), Sherwin-Williams (paint dominance), AutoZone (parts inevitability), , McDonald's (global franchise real estate empire).

Each position represents a business we expect to thrive over 10-30 year horizons. Not momentum plays. Not meme stocks. Enterprises with durable competitive advantages and proven management.

Layer VI – Strategic asymmetric risk (~8%)

This is the part that can actually change everything—but never enough to break us:

Bittensor ($TAO) + heavy subnet basket: Chutes, Lium, Ridges, Affine, Score, Quantum, Safe Scan, Synth, Sportstensor, Targon, PTN, Nineteen, Hone, Neural Internet, Dippy, Proprietary Trading—deep conviction in decentralized AI infrastructure.

Crypto financial infrastructure: Coinbase (COIN), Galaxy Digital (GLXY)—regulated on-ramps to the digital asset ecosystem.

DeFi blue chips: Chainlink (LINK) + stLINK, Aave (AAVE)—battle-tested protocols that have survived multiple cycles.

Ethereum ecosystem: eETH + rsdETH + RSDL (ether.fi restaking), rETH and wstETH (liquid staking), Sky (SKY) + Spark (SPARK), Ether.fi, Morpho, Aerodrome—deep exposure to Ethereum's evolving DeFi and security infrastructure.

Solana ecosystem: Jupiter (JUP), Raydium, Render + SOL staked as jupSOL, mSOL, and INF (Sanctum)—infrastructure plays on Solana's continued evolution.

Pre-IPO asymmetric bets: xAI, Anthropic—private market exposure to the AI infrastructure race before public markets get access.

Notice what this layer is not a massive YOLO in the portfolio context. Even if every single position here went to zero tomorrow—a Black Swan event—we'd lose 8% of total wealth. Painful, but not ruinous. We'd survive to compound another day.

The table that says it all

| Sagix principle | How the portfolio proves it |

|---|---|

| Survival > optimization | 57% in assets that never go to zero |

| Real diversification | Six distinct layers with different risk profiles |

| Zero leverage | No margin, no borrowing, no madness |

| Time is the ultimate multiplier | 92% in assets built to last decades |

| Ergodicity respected | Asymmetric risk sized at 8%—survivable even in total loss |

Do we practice what we preach?

Let's check our philosophy against reality:

We say: "Survival trumps optimization." The portfolio proves it: over half our capital sits in positions designed to survive any market condition. Layers I through IV together represent 57% allocation to stability, income, and real assets.

We say: "Zero leverage, ever." The portfolio proves it: not a single position involves margin or borrowed funds. When crypto crashes, we don't get margin called—we go shopping.

We say: "True diversification requires assets that don't collapse together." The portfolio proves it: we hold government bonds, US utilities, European dividend ETFs, REITs, healthcare companies, and crypto. When Bitcoin drops 50%, Southern Company doesn't care.

We say: "Position sizing prevents catastrophe." The portfolio proves it: with dozens of holdings across six layers, no single position can destroy us. Even our highest-conviction crypto bets are sized to be survivable losses.

We say: "Time in the market beats timing the market." The portfolio proves it: "Zero sales, only sacred buying" isn't just a slogan—it's the policy. We accumulate quality and hold through volatility.

We say: "Business growth compounds your compounding." The portfolio proves it: Microsoft, JPMorgan, and Johnson & Johnson have expanded their dividends for decades. Their business growth amplifies our compound returns.

We say: "The person who got rich from concentration is the exception, not the rule." The portfolio proves it: even in crypto—where concentration temptation runs highest—we spread across infrastructure (Chainlink), L1s (Solana), DeFi protocols (Aave, Sky, Jupiter), restaking (ether.fi), regulated equities (Coinbase, Galaxy), and an entire Bittensor subnet ecosystem. Even our pre-IPO bets span both xAI and Anthropic rather than picking a single AI winner.

This is not the portfolio for getting rich in 2026

Let's be direct about what The Sagix Compound is designed to accomplish:

This is the portfolio for being wealthy in 2036, 2046, 2056—and sleeping like a baby when the next crypto winter hits.

This is the portfolio for compounding through multiple market cycles instead of blowing up during one.

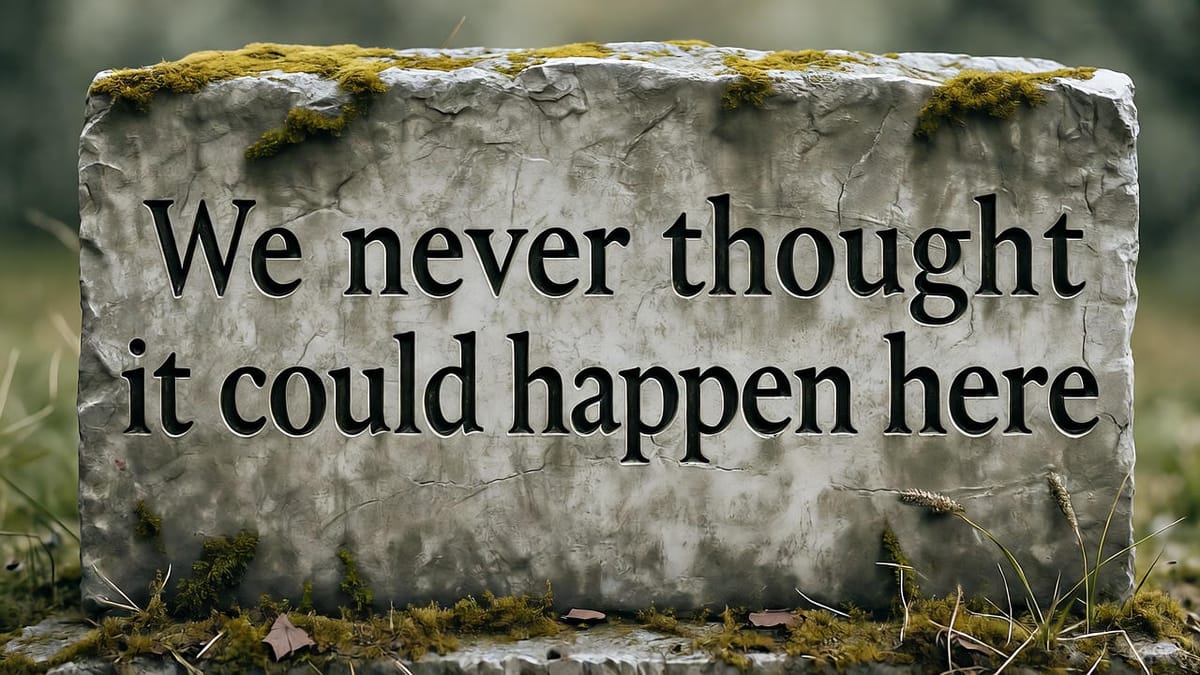

This is the portfolio for someone who understands that the graveyard of crypto is full of people who sized positions too large, used leverage they shouldn't have, and chased yields that evaporated.

The hare sprints ahead, posts screenshots of gains, mocks the tortoise for being boring. Then the storm comes. The hare gets liquidated. The tortoise keeps moving.

We are the tortoise. We intend to keep moving for decades.

What does your barbell look like?

The specific positions in our portfolio matter less than the structure. You might prefer different utilities, different healthcare companies, different crypto protocols. That's fine. What matters is the architecture:

Do you have an anchor that provides stability and buying power during crashes?

Do you have defensive ballast generating income regardless of market conditions?

Do you have tax-efficient structures compounding international dividends?

Do you have real assets that protect against inflation and provide tangible value?

Do you have quality growth exposure to businesses that compound over decades?

Is your asymmetric risk sized so that total loss wouldn't destroy you?

If yes to all six, you've built a Compound of your own. If no to any, you might be a hare who doesn't know it yet.

The race doesn't go to the swift—it goes to those still running when the swift have exhausted themselves.

Sagix Apothecary – December 2025

Real positions. Zero sales. Only sacred buying.

Disclaimers

Educational purpose only: This content is for educational purposes and does not constitute financial, investment, or legal advice. The portfolio positions described represent actual holdings of the author and are shared purely for educational illustration of investment philosophy principles. This is not a recommendation to buy, sell, or hold any securities or crypto assets mentioned. Always conduct your own research and consult professionals before making financial decisions.

Risk warning: Cryptocurrency and DeFi involve significant risks, including total loss of capital. Traditional equities, REITs, and bonds also carry risk of loss. Pre-IPO investments are illiquid and carry substantial risk of total loss. Past performance does not indicate future results. All investments carry risk.

Position disclosure: The author holds positions in all securities and crypto assets mentioned in this article. This creates potential conflicts of interest. Readers should consider this when evaluating any information presented.

AI-assisted content: This analysis was prepared with AI assistance (Claude, Anthropic). While efforts were made to ensure accuracy, readers should independently verify information before relying on it.

No professional relationship: This content does not create any advisory or fiduciary relationship. Readers seeking professional guidance should consult qualified professionals licensed in their jurisdiction.

Liability: The authors, Sagix Apothecary, and Genesis Address Publishing LLC assume no responsibility for errors, omissions, or consequences arising from use of this information. Users assume full responsibility for any decisions based on this content.

Publication Information: December 2025 | Series: Sagix Apothecary | Publisher: Genesis Address Publishing LLC