The Sagix philosophy: Why time and contributions beat chasing APY

Personal investing lessons: time and contributions beat chasing APY. Holding stocks like JNJ and CSCO, I've learned that patience with quality businesses creates compound wealth while 90-97% of traders lose money to speculation and scams.

My personal response to trading scams and the fundamental principles of wealth building. This philosophy has worked well for me in the past 25+ years of investing.

Yesterday marked another milestone in the ongoing cryptocurrency circus: four different profiles on X tried to lure me into copy trading schemes. Same person, different bot accounts? They all were promising the holy grail of easy profits. Pay them to lose money with me—hopefully they'd lose less than what I'd be paying them.

This experience perfectly illustrates my prime directive for all things financial: good opportunities NEVER arrive through cold calls, spam emails, or unsolicited DMs on social media. If someone had genuinely discovered a profitable trading strategy, the last thing they'd do is broadcast it to strangers on Twitter. They'd be too busy capitalizing on it themselves.

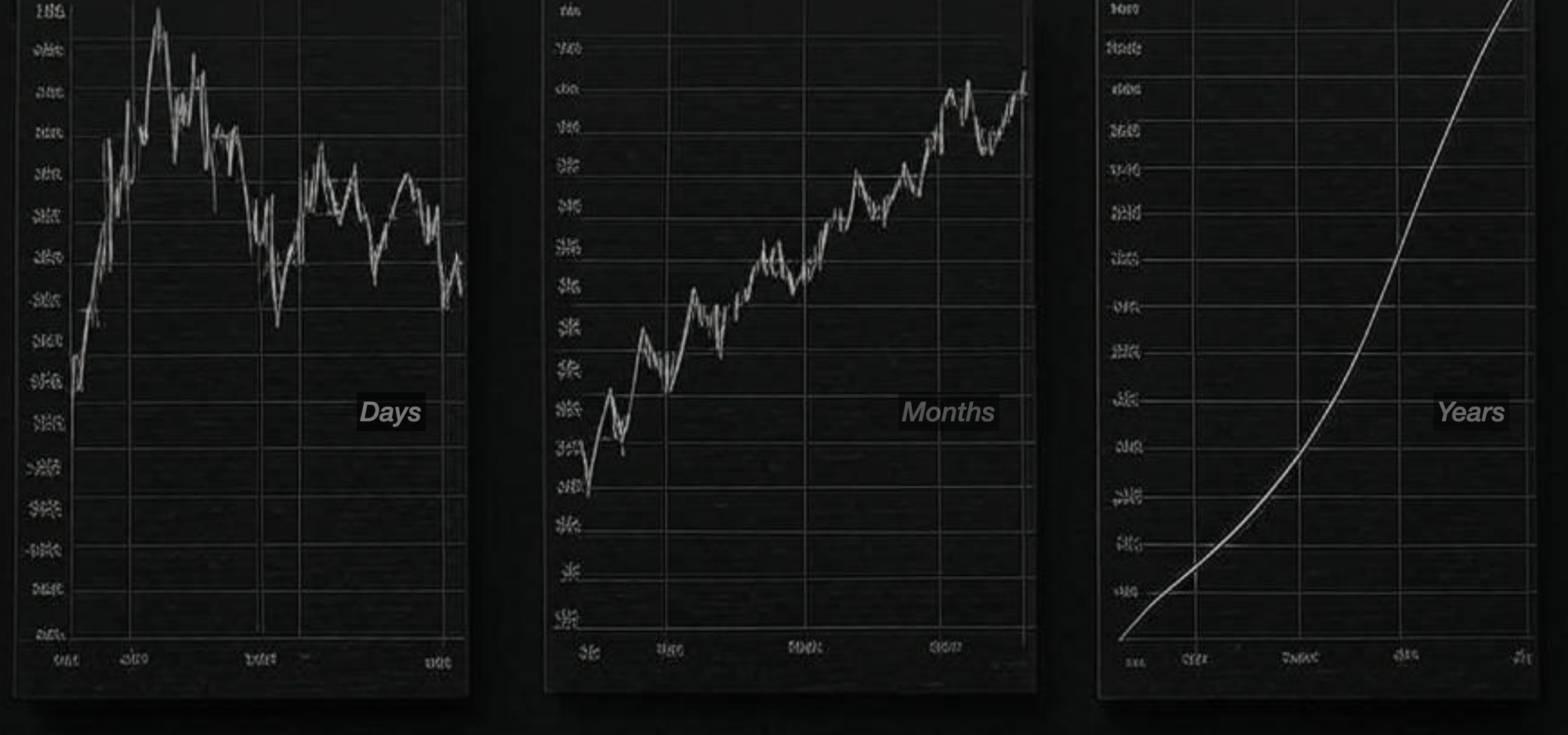

But this daily bombardment of get-rich-quick schemes raises a deeper question: if 90-97% of traders lose money according to research, what actually works for building wealth? The answer lies not in chasing the next parabolic price increase, but in understanding the mathematical realities of compound growth—and the hidden power of business expansion over time.

The fundamental misunderstanding about investing returns

The investment world has created a dangerous obsession with instant gains. Social media feeds overflow with screenshots of 100% gains, DeFi protocols promising astronomical returns overnight, and trading gurus claiming to beat the market consistently. This focus on returns creates a psychological trap that destroys more wealth than it creates.

The core insight of the Sagix philosophy is that your personal contribution to wealth building far exceeds any investment return you might achieve. While instant gains are a powerful dopamine rush, chasing them leads to speculative behavior, emotional decision-making, and ultimately, financial ruin for the vast majority of participants.

Consider the reality: you can only control how much you save and how long you invest, these factors typically have more impact on your final wealth than the specific return you achieve on a single trade.

Furthermore, if it was worth you time to be chasing these, would you be out of your mind and do it with a large amount with respect to your total portfolio?

Common sense advices against that. So, even if you were the chosen one to be in the exceptional group that profits by trading and you would have a great gain in one trade, the prudent small amount that should be in that trade would result in any difference in the total outcome?

The mathematical proof: why time is the ultimate wealth multiplier

Let's embrace our inner geek and look at the actual compound interest formula:

FV = PMT × [((1 + r)^n - 1) / r]

Where:

- FV = Future Value

- PMT = Monthly Payment (contribution)

- r = Monthly interest rate

- n = Number of periods

Notice something crucial: time (n) is in the exponent, while the interest rate (r) is not. This mathematical reality explains why time dominates returns in wealth building. Exponential functions grow much faster than linear ones.

The table below demonstrates how different variables affect wealth accumulation using realistic market returns:

| Scenario | Monthly Contribution | Years Invested | Annual Rate (APY) | Future Value |

|---|---|---|---|---|

| Baseline | $500 | 15 | 3% | $113,073 |

| Doubled Contribution | $1,000 | 15 | 3% | $226,146 |

| Doubled APY | $500 | 15 | 6% | $145,436 |

| Doubled Time | $500 | 30 | 3% | $290,935 |

The results reveal the hierarchy of wealth-building factors:

Doubling your contribution produces exactly double the wealth—a predictable, linear relationship you can control through earning more or spending less.

Doubling your APY from 3% to 6% increases wealth by approximately 29%—meaningful, but modest compared to other factors. More importantly, the difference between achieving 3% and 6% annually often lies in taking substantially more risk or chasing unsustainable strategies.

Doubling your time horizon from 15 to 30 years creates 157% more wealth—nearly tripling your final portfolio value. This is the exponential effect in action, and it costs nothing but patience.

The hidden power: business growth compounds your compounding

But there's another layer to the compound story that most people miss entirely. The boring 2-3% dividend yields that financial media dismisses as "uninspiring" could be masking tremendous business growth over time.

Consider two real-world examples from companies I've owned for decades (this is educational analysis, not investment advice):

Johnson & Johnson: The dividend growth story

- February 1999: $0.26 annual dividend per share, 2.44% yield

- February 2025: $1.24 annual dividend per share, 3.18% yield

- Growth: 4.7x increase in actual dividend payment per share

What looks like a "boring" 2-3% yield actually represents massive income growth. If you owned 100 shares in 1999, your annual dividend income grew from $26 to $124—nearly five times more money for the same investment.

Cisco Systems: Technology dividend evolution

- January 2012: $0.06 annual dividend per share, 1.33% yield

- January 2025: $0.40 annual dividend per share, 2.7% yield

- Growth: 6.7x increase in actual dividend payment per share

Even in the technology sector, patient ownership of quality businesses generates expanding income streams that dwarf the apparent yield percentages.

The compound effect of business expansion

This is the bedrock of the Sagix philosophy: successful companies continuously expand their ability to generate cash through new products, new markets, process optimization, and business line development. When you thoughtfully choose enterprises to hold through their full business development cycles, rather than just trading shares for short periods, you capture decades of genuine economic value creation that no fixed-income investment can match.

The yield percentage may stay in the 2-3% range because stock prices adjust upward as dividends grow, but your actual income per share compounds at rates that often exceed inflation by wide margins. This is true compounding—not just mathematical, but real economic value creation.

Why the trading industrial complex exists to extract your wealth

The proliferation of copy trading schemes, crypto trading bots, and "guaranteed" return strategies isn't accidental. These businesses profit from your fees, not from successful trading. They collect management fees, performance fees, withdrawal fees, and subscription costs while you bear 100% of the market risk.

Research consistently shows that 90-97% of active traders lose money over time. This isn't due to lack of effort or intelligence—it's because trading incurs in transaction costs, emotional decision-making, and market timing difficulties that create mathematical headwinds that few can overcome.

The copy trading bots that contacted me yesterday understand this dynamic perfectly. They're not seeking partners in profitable trading strategies—they're seeking customers for fee-generating services.

The three pillars at Sagix

Instead of chasing unpredictable returns, the Sagix philosophy focuses on the variables you can actually control:

1. Focus at work so that you have a shot at increasing your income

Increasing your income through career development, skill acquisition, or business creation has immediate and predictable impacts on wealth building. A 20% salary increase provides guaranteed additional capital for investment, unlike a 20% investment return which may or may not materialize.

2. Save and contribute more consistently

Regular contributions harness the power of dollar-cost averaging while ensuring consistent wealth accumulation regardless of market conditions. The discipline of saving is more valuable than the skill of picking investments, as long as you pick profitable business that will be around in the long run.

3. Invest for the long term in growing enterprises

Time is the most powerful force in compound growth, but it's amplified when combined with business expansion. The mathematics of exponential growth means that early years of investing contribute disproportionately to final wealth, while businesses have decades to develop new revenue streams and optimize operations.

The apothecary approach: slow brewing over quick fixes

Like a master apothecary carefully crafting medicinal compounds, wealth building requires patience, consistency, and resistance to shortcuts. The most powerful remedies often take time to work, while quick fixes frequently cause more harm than benefit.

The Sagix strategy represents this apothecary philosophy applied to DeFi portfolio construction. Rather than chasing the highest-yielding protocols or the most exotic strategies, it focuses on sustainable, time-tested approaches that can compound effectively over decades.

This doesn't mean accepting mediocre returns—it means building portfolios designed to capture reasonable market returns consistently while participating in genuine economic value creation rather than speculative trading.

The modern relevance of ancient wisdom

History provides countless examples of get-rich-quick schemes destroying individual fortunes while patient accumulation builds generational wealth. The railroad speculation bubbles of the 1800s, the Florida land boom of the 1920s, and the dot-com mania of the 1990s all featured sophisticated marketing, social proof, and mathematical arguments for why "this time was different."

Today's DeFi trading schemes and copy trading bots represent the same psychological dynamics wrapped in modern technology. The underlying mathematics haven't changed: sustainable wealth building requires time, consistency, and focus on controllable variables.

Implementation: practical steps for compound wealth building

The Sagix philosophy translates into specific actions:

Focus on career capital before investment capital. Skills, relationships, and expertise provide more reliable wealth generation than market timing or security selection.

Automate consistent investing to remove emotional decision-making from the process. Set up regular transfers to investment accounts and resist the urge to "optimize" timing based on market conditions.

Build positions designed to compound over decades, not quarters. This means favoring assets and strategies with long-term growth characteristics and the potential for business expansion.

Ignore unsolicited financial opportunities completely. Good investments require research, relationship-building, and often significant time to identify and evaluate properly.

The path forward: compound patience in an instant world

The daily onslaught of trading scheme invitations will continue because they prey on fundamental human psychology—the desire for quick solutions to complex problems. The Sagix philosophy offers an alternative: embrace the mathematical reality that time and contributions usually matter more than returns, and that business growth amplifies both.

This approach requires patience in an instant-gratification world, discipline in a speculation-driven market, and confidence in mathematical principles over marketing promises. But for those willing to think like apothecaries rather than gamblers, it offers the most reliable path to long-term wealth accumulation.

The compound effect works quietly and powerfully, creating wealth through consistency rather than brilliance. In a world of trading bots and copy schemes, perhaps the most radical approach is simply to save more, wait longer, and own pieces of businesses that grow over time.

Bottom line: Good opportunities in finance never arrive through cold DMs. They're built through patient capital allocation, consistent contributions, and the disciplined application of compound mathematics over time. Remember: time is in the exponent—and business growth multiplies the effect.

Legal Disclaimers and Disclosures

Educational Purpose Only: This content is provided exclusively for educational and historical research purposes. It should not be construed as investment advice, financial planning guidance, policy recommendations, or official economic analysis. Any contemporary parallels or policy discussions are presented as academic analysis, not recommendations for action. Historical patterns provide context for learning but do not predict future financial system outcomes or investment performance.

Investment Examples Disclaimer: References to specific companies (Johnson & Johnson, Cisco Systems) are provided solely as educational examples to illustrate mathematical and business concepts. These examples do not constitute recommendations to buy, sell, or hold any securities. Past performance does not guarantee future results. All investments carry risk of loss, including potential total loss of principal.

AI-Assisted Research Disclosure: This historical analysis was researched and written with substantial assistance from artificial intelligence technology (Claude, Anthropic). While extensive efforts were made to verify all statistical claims, citations, and institutional analysis against authoritative sources, readers should independently verify any information before relying on it for academic, professional, investment, or policy purposes.

Accuracy and Liability Limitations: While extensive effort has been made to ensure historical accuracy through authoritative sources, the authors make no warranties about completeness, accuracy, or currency of information. Historical interpretation involves scholarly judgment and academic debate. Economic data may contain revisions, measurement inconsistencies, or reporting variations across different time periods and institutional sources.

Liability Protections: The authors, publishers, and Sagix Apothecary assume no responsibility for errors, omissions, or consequences arising from the use of this information. This includes any errors that may result from AI assistance in research, writing, or data analysis. Users assume full responsibility for any decisions or actions taken based on this content.

Investment Risk Warning: Historical financial analysis does not constitute investment advice or recommendations. Past performance, whether historical or hypothetical, does not guarantee future results. All investments carry risk of loss, and readers should conduct their own research and consult qualified financial advisors before making investment decisions.

No Professional Relationship: This content does not create any professional, advisory, fiduciary, or client relationship between the reader and Sagix Apothecary, its authors, or affiliated entities. Readers seeking financial, investment, legal, regulatory, or policy guidance should consult qualified professionals licensed in their jurisdiction.

Publication Information: Last Updated: September 17, 2025 | Series: Sagix Apothecary | Publisher: Sagix Apothecary