Modern portfolio construction: A multi-asset approach for the digital age

Integrating Traditional Wisdom with Contemporary Realities

Integrating traditional wisdom with contemporary realities

The modern investor must embrace complexity while adhering to timeless principles. The correlation matrix is your compass, diversification is your strategy, and patience is your greatest asset.

Date: July 19, 2025. Synthesizing insights from Ray Dalio’s All Weather Philosophy, Peter Lynch’s Growth at Reasonable Price, and Warren Buffett’s Value Investing Principles

Executive summary

This white paper presents a comprehensive framework for modern portfolio construction that bridges traditional investment wisdom with the realities of today’s digital asset landscape. By applying the time-tested principles of legendary investors — Ray Dalio’s risk parity approach, Peter Lynch’s understanding of what you own, and Warren Buffett’s focus on long-term value — we construct a portfolio methodology that addresses the unique challenges facing US investors in 2025.

The analysis reveals that while digital assets have introduced new correlation dynamics, the fundamental principles of diversification remain unchanged: true portfolio resilience comes not from owning many assets, but from owning assets that respond differently to various economic environments.

Our key finding is the emergence of what we term the “Global Risk-On Cluster” — a highly correlated group consisting of US technology stocks, international developed markets, and digital assets that move in unison during liquidity cycles. This discovery necessitates a more nuanced approach to diversification that explicitly accounts for this modern reality.

Table of contents

- Philosophical Foundation: Learning from the Masters

- The Modern Diversification Challenge

- Correlation Analysis: The Statistical Foundation

- The Digital Asset Integration

- Global Multi-Asset Framework in USD Terms

- Crypto Asset Correlations: USD vs BTC Denominations

- Strategic Portfolio Construction

- Implementation Guidelines

- Conclusions and Future Considerations

1. Philosophical foundation: Learning from the masters

Ray Dalio’s All Weather Wisdom

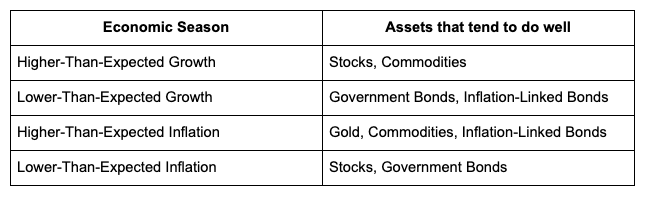

Dalio’s fundamental insight remains as relevant today as ever: don’t try to predict the future; build a portfolio that can weather any economic season. The four economic environments — higher/lower than expected growth and inflation

These two factors can each be rising or falling, creating four potential economic “seasons” that a portfolio should be prepared to endure:

Economic Season

However, our analysis reveals a crucial modification for the digital age: traditional correlations have been disrupted by the emergence of a “Global Risk-On” cluster that responds primarily to liquidity conditions rather than fundamental economic drivers.

Peter Lynch’s “Know what you own” principle

Lynch’s emphasis on understanding your investments takes on new meaning in the digital asset era. When applying his principle to cryptocurrencies, investors must distinguish between:

- Bitcoin: A scarce digital store of value with fixed supply mechanics.

- Ethereum: A utility token powering a decentralized computing platform.

- Altcoins: Highly speculative bets on emerging blockchain technologies.

Lynch would likely classify most altcoins as “fast growers” with correspondingly high risk — suitable only for investors who thoroughly understand the underlying technology and market dynamics.

Warren Buffett’s long-term value focus

Buffett’s skepticism of assets that don’t produce cash flows applies directly to digital assets. However, his broader principle — investing in assets with durable competitive advantages — can be adapted. Bitcoin’s network effects and first-mover advantage in digital scarcity represent what Buffett might recognize as an “economic moat” in the digital realm.

Key Insight: Combine Buffett’s patient capital approach with an understanding that some new asset classes may derive value from network effects and monetary properties rather than traditional cash flows.

2. The modern diversification challenge

The traditional 60/40 stock/bond portfolio emerged in an era of:

- Distinct asset class behaviors

- Predictable negative correlation between stocks and bonds

- Limited global capital mobility

- Absence of digital assets

Today’s reality includes:

- Increased correlation during crisis periods

- Central bank policy as the primary driver of asset prices

- Digital assets as a new, highly volatile asset class

- Global capital flows that synchronize markets worldwide

The inadequacy of traditional approaches

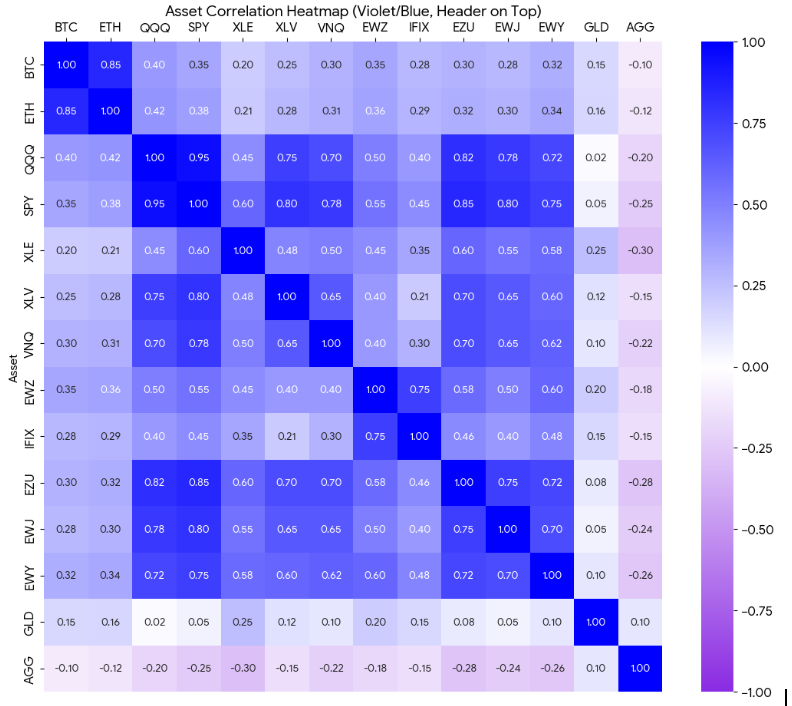

Our correlation analysis reveals that simply adding international exposure through developed market ETFs (EZU, EWJ, EWY) provides limited diversification benefit, with correlations to US markets (SPY) ranging from 0.70 to 0.85. This challenges the conventional wisdom that geographic diversification alone provides meaningful risk reduction.

- Key Insight: Geographic diversification works only when combined with economic structure diversification. Investing in Japan (EWJ) provides little benefit if Japan’s economy responds similarly to the same global forces affecting the US.

3. Correlation analysis: The statistical foundation

methodology: USD-denominated analysis

All foreign assets are analyzed in USD terms to reflect the true return experience of a US-based investor. This approach captures both:

- Local asset performance

- Currency movement impact

The comprehensive correlation matrix

Correlations in modern portfolio theory are visualized through a spectrum of colors, each representing the strength and direction of the relationship between different assets. This intuitive color-coding allows investors to quickly grasp the diversification benefits or risks within their portfolios.

🟣 Violet shades are used to indicate negative correlations. This means that as the value of one asset increases, the value of the other asset tends to decrease, and vice versa. Strongly negative correlations (represented by deeper violet hues) are highly desirable in portfolio construction as they offer significant diversification benefits. When assets move in opposite directions, they can help to reduce overall portfolio volatility, potentially leading to more stable returns over time.

⚪ White signifies correlations that are near zero. A correlation of zero suggests that there is no linear relationship between the movements of two assets. Their price changes are independent of each other. While not as impactful for diversification as negative correlations, assets with near-zero correlations still offer some level of portfolio stability by not moving in lockstep with other holdings.

🔵 Blue shades represent positive correlations. This indicates that as the value of one asset increases, the value of the other asset also tends to increase, and similarly, when one decreases, the other follows suit. Lighter blue shades suggest a weak positive correlation, while deeper blue hues denote a strong positive correlation, meaning the assets tend to move very closely together. While some positive correlation is inevitable in a well-functioning market, a portfolio heavily weighted with strongly positively correlated assets can be highly susceptible to significant swings, as a downturn in one asset class is likely to be mirrored by others. Investors typically aim to minimize strong positive correlations to enhance portfolio resilience.

Key structural insights

- The Global Risk-On Cluster: QQQ, SPY, EZU, EWJ, EWY, and to a lesser extent BTC and ETH, form a highly correlated group (0.70–0.95 correlations). This cluster responds primarily to:

- Federal Reserve policy

- Global liquidity conditions

- Risk appetite sentiment

- True Diversifiers: Only three asset categories provide meaningful diversification:

- Gold (GLD): Near-zero correlation to everything (0.02–0.25 range)

- Brazilian Assets (EWZ, IFIX): Moderate correlation to global markets but driven by distinct local factors

- Energy (XLE): While correlated to broader markets, shows lower correlation to tech/growth assets

4. The digital asset integration

Beyond the “digital gold” narrative

The analysis reveals that Bitcoin does not behave like traditional gold. With correlations of 0.35–0.40 to major equity indices, Bitcoin exhibits characteristics more similar to a growth/technology asset than a safe haven.

This challenges the popular “digital gold” narrative and suggests Bitcoin should be positioned as:

- A scarcity-premium asset during periods of monetary expansion.

- A high-beta growth asset during risk-on/risk-off cycles.

- A long-term store of value with significant short-term volatility.

The crypto monolith effect

High internal correlation within crypto assets (BTC-ETH: 0.85) means that:

- Adding multiple cryptocurrencies provides minimal diversification benefit.

- The entire crypto allocation should be considered as a single, highly volatile growth asset.

- Position sizing must account for the collective volatility of all crypto holdings.

5. Crypto asset correlations: USD vs BTC denominations

The dual nature of crypto analysis

Understanding crypto requires analyzing correlations in two contexts:

- USD-Denominated Analysis (Portfolio Allocation Perspective) When measured in USD, crypto assets show:

- High internal correlation: BTC-ETH (0.85), indicating they move as a block.

- Moderate correlation to risk assets: BTC-QQQ (0.40), suggesting they’re part of the “risk-on” trade.

- Low correlation to defensive assets: BTC-GLD (0.15), confirming they’re not a safe haven.

- Investment Implication: Crypto allocation should be sized based on total portfolio volatility tolerance, not individual asset analysis.

- BTC-Denominated Analysis (Crypto Portfolio Management) When pricing altcoins in BTC terms (e.g., ETH/BTC), we observe:

- Near-zero correlation between alt/BTC ratios and BTC/USD price movements.

- High correlation between different alt/BTC ratios (0.70–0.85).

- Distinct risk-on/risk-off cycles within the crypto ecosystem.

- Investment Implication: Within a crypto allocation, there are opportunities for active management through alt/BTC rotation, but these are independent of broader portfolio dynamics.

The three-layer crypto framework

- Layer 1: Total Crypto Allocation (based on USD correlations to traditional assets)

- Layer 2: BTC vs. Alt Allocation (based on conviction about crypto ecosystem development)

- Layer 3: Alt Selection (based on fundamental analysis of specific protocols)

Most investors should focus only on Layers 1 and 2.

Crypto allocation sizing

Drawing from Lynch’s growth stock framework:

- Conservative Investor: 2–5% (treat as a small “fast grower” position)

- Moderate Investor: 5–10% (meaningful but not portfolio-determining position)

- Aggressive Investor: 10–20% (significant growth allocation)

- Buffett’s Perspective: Any allocation above 5% requires conviction that you understand something about crypto that the market doesn’t — a high bar given the speculative nature of the asset class.

Integration strategy

Rather than treating crypto as a separate allocation, integrate it within the growth component of the portfolio:

- Traditional Approach: 60% Stocks, 35% Bonds, 5% Crypto (as an example)

- Integrated Approach: 70% Growth Assets (including crypto within this allocation), 30% Defensive Assets

6. Global multi-asset framework in USD terms

The four-pillar framework

Drawing from Dalio’s All Weather philosophy, we propose a four-pillar approach adapted for modern markets:

- Pillar 1: Core Growth Engine (40–50% allocation)

- US Large Cap (SPY): 20–25%

- US Technology (QQQ): 10–15%

- Digital Assets (BTC/ETH): 5–10%

- Rationale: These assets benefit from economic growth, technological innovation, and monetary expansion.

- Pillar 2: Inflation Hedge (20–25% allocation)

- Energy (XLE): 8–10%

- Real Estate (VNQ): 7–10%

- Gold (GLD): 5–8%

- Rationale: These assets protect against unexpected inflation through different mechanisms — energy through commodity exposure, real estate through rent adjustments, and gold through monetary debasement protection.

- Pillar 3: Geographic Diversifier (15–20% allocation)

- Emerging Markets (EWZ): 8–12%

- EM Real Estate (IFIX): 3–5%

- Other EM (selective): 2–3%

- Rationale: Provides exposure to different economic cycles, currency regimes, and growth patterns.

- Pillar 4: Defensive Assets (15–20% allocation)

- Healthcare (XLV): 8–10%

- High-Quality Bonds: 5–8%

- Cash/Short-term instruments: 2–5%

- Rationale: Provides stability during economic downturns and deflation.

The anti-correlation imperative

- Key Principle: Each pillar should respond differently to the same economic stimulus.

When the Federal Reserve cuts rates:

- Pillar 1 should benefit from increased liquidity.

- Pillar 2 should benefit from inflation expectations.

- Pillar 3 may benefit from carry trade dynamics.

- Pillar 4 provides stability if the stimulus fails.

7. Strategic portfolio construction

The crypto portfolio

Synthesizing the insights above, we propose three model portfolios:

Conservative (risk level: Low-moderate)

- US Core (SPY): 30%

- US Healthcare (XLV): 15%

- Energy (XLE): 10%

- Real Estate (VNQ): 10%

- Gold (GLD): 10%

- Brazil Equity (EWZ): 8%

- Brazil Real Estate (IFIX): 5%

- Bitcoin (BTC): 5%

- Bonds/Cash: 7%

Philosophy: Maximum diversification with minimal crypto exposure.

Balanced (risk level: Moderate)

- US Core (SPY): 25%

- US Tech (QQQ): 10%

- US Healthcare (XLV): 12%

- Energy (XLE): 10%

- Real Estate (VNQ): 8%

- Gold (GLD): 8%

- Brazil Equity (EWZ): 10%

- Brazil Real Estate (IFIX): 5%

- Bitcoin (BTC): 7%

- Ethereum (ETH): 3%

- Bonds/Cash: 2%

Philosophy: Balanced exposure to all economic scenarios with meaningful crypto allocation.

Growth (risk level: moderate-high)

- US Core (SPY): 20%

- US Tech (QQQ): 15%

- US Healthcare (XLV): 10%

- Energy (XLE): 10%

- Real Estate (VNQ): 8%

- Gold (GLD): 5%

- Brazil Equity (EWZ): 12%

- Brazil Real Estate (IFIX): 5%

- Bitcoin (BTC): 10%

- Ethereum (ETH): 5%

Philosophy: Tilted toward growth and crypto while maintaining all-weather characteristics.

Dynamic rebalancing framework

- Quarterly Rebalancing: Review and rebalance to target allocations.

- Annual Review: Assess whether correlation relationships have changed significantly.

- Crisis Response: During 20%+ drawdowns, consider tactical increases to the most oversold asset classes.

8. Implementation guidelines

Portfolio construction process

- Determine Risk Tolerance: Use correlation matrix to understand how different allocation sizes would have behaved historically.

- Select Base Framework: Choose conservative, balanced, or growth template.

- Customize for Personal Situation: Adjust based on age, income stability, tax situation.

- Implement Gradually: Phase in crypto and international allocations over 3–6 months.

- Monitor and Rebalance: Stick to discipline regardless of short-term performance.

Common implementation mistakes

- Over-diversification: Adding more assets without checking correlations.

- Under-diversification: Focusing only on US assets or crypto assets.

- Timing the market: Trying to predict when to increase/decrease crypto allocation.

- Ignoring currency impact: Not accounting for USD strength/weakness in international positions.

9. Conclusions and future considerations

Key insights

- The Modern Risk Landscape: Traditional correlations have been disrupted by the emergence of a “Global Risk-On Cluster” that includes US tech stocks, developed international markets, and crypto assets.

- Crypto’s Role: Digital assets should be positioned as high-beta growth assets, not as safe havens or inflation hedges in the traditional sense.

- Geographic Diversification: Effective international diversification requires exposure to markets with fundamentally different economic structures (like Brazil), not just different geographic locations.

- Gold’s Unique Position: Gold remains the only truly uncorrelated asset, maintaining its role as the ultimate portfolio diversifier.

- The Correlation-Allocation Imperative: Portfolio construction must start with correlation analysis, not asset class enthusiasm.

The timeless principles ppplied

- Ray Dalio’s All Weather: Build for resilience across economic seasons, not for prediction of specific outcomes.

- Peter Lynch’s Understanding: Know what you own — especially critical for crypto assets where the technology and use cases are evolving rapidly.

- Warren Buffett’s Patience: Maintain long-term focus despite the short-term volatility introduced by digital assets.

Future considerations

As markets continue evolving, monitor:

- Changing Crypto Correlations: Will institutional adoption reduce or increase correlation to traditional assets?

- Geopolitical Fragmentation: Will global correlations decrease as economic blocs form?

Final recommendation

The modern investor must embrace complexity while adhering to timeless principles. The correlation matrix is your compass, diversification is your strategy, and patience is your greatest asset.

Remember: The goal is not to own the best-performing asset of the next decade — it’s to own a portfolio that can prosper regardless of which asset that turns out to be.

Disclaimer:

This analysis is provided strictly for educational purposes. All investments inherently carry risk of loss. Historical correlations do not guarantee future relationships. It is strongly recommended to consult with qualified financial professionals prior to implementing any investment strategy. The information contained within this document is for informational purposes only and should not be construed as financial, investment, legal, tax, or any other form of professional advice. This content does not constitute a recommendation, endorsement, offer, or solicitation to buy or sell any securities or to engage in any specific investment strategy. While the information presented is believed to be reliable, no representation or warranty, express or or implied, is made regarding its accuracy, completeness, or suitability for any particular purpose. All readers are strongly encouraged to conduct their own independent due diligence and to seek counsel from their own qualified professional advisors to ascertain the suitability of any investment. The authors and publishers disclaim all liability for any loss or damage arising from the use of or reliance upon the information provided herein.

Further reading: