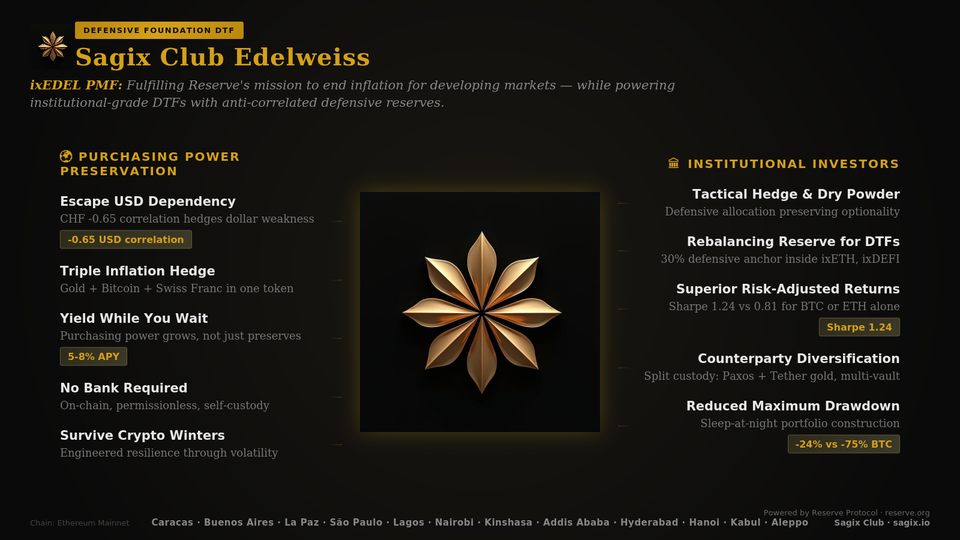

Sagix Club Edelweiss: a risk parity strategy for all economic regimes

Club Edelweiss (ixEDEL) is a defensive DTF on Reserve Protocol implementing risk parity principles on-chain. The portfolio balances yield-bearing stablecoins, tokenized gold, overcollateralized Swiss Franc, and Bitcoin to weather any economic regime, delivering crypto upside while cutting drawdowns.

A defensive DTF built on Reserve Protocol

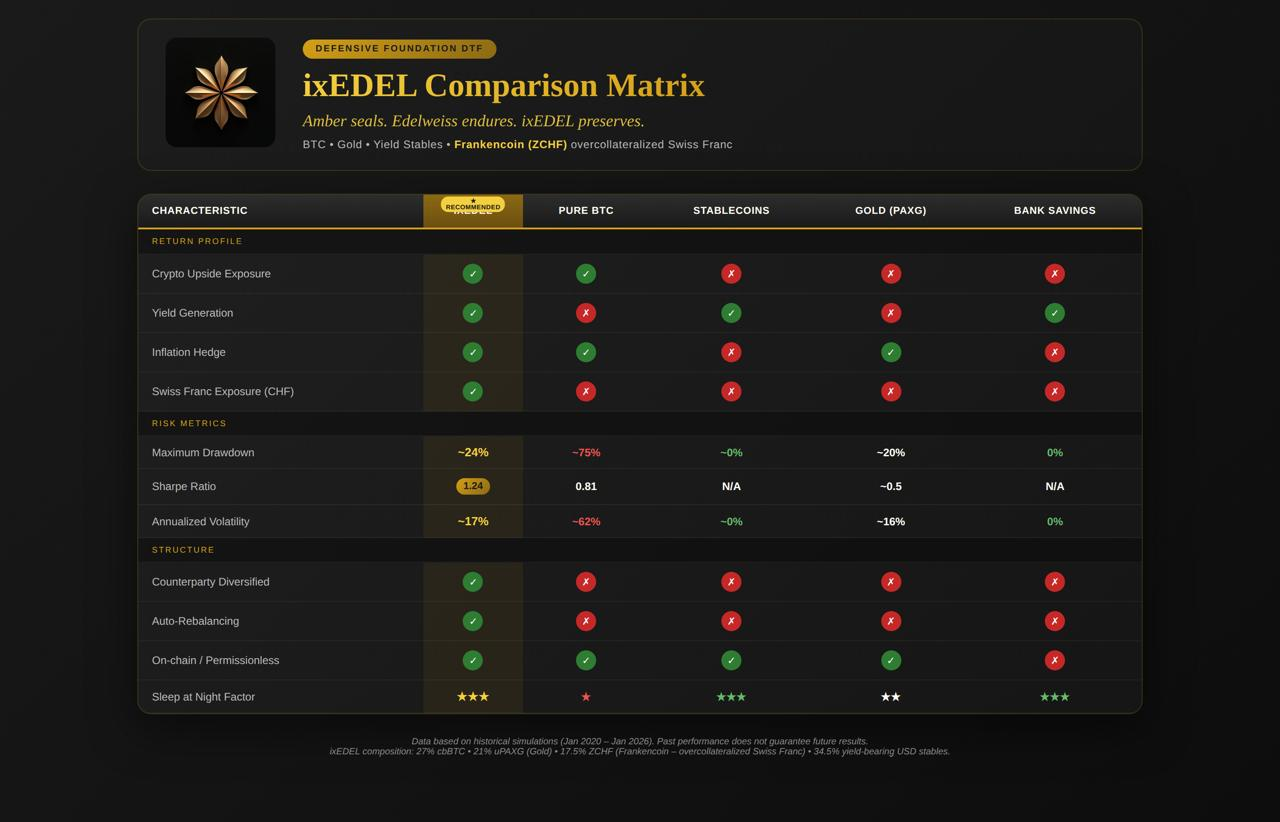

- Resilient Portfolio Strategy: Club Edelweiss (ixEDEL) uses risk parity to balance 40% yield-stablecoins, 20% tokenized gold, 20% Swiss Franc, and 20% Bitcoin for stability in any economic regime—inflation, deflation, growth, or stagnation.

- Crypto Upside with Reduced Risk: Captures Bitcoin's potential with reduced through low-correlation assets, avoiding macro bets for engineered diversification.

- Strong Performance Metrics: Backtested Sharpe ratio of 1.24 (2020–2026) shows superior risk-adjusted returns compared to traditional holdings.

- Transparent & Community-Driven: On-chain Ethereum setup with yearly rebalancing via votes and a low 0.30% annual fee.

The thesis

Crypto investors face a familiar problem: the assets that deliver the highest returns also suffer the most devastating drawdowns. Bitcoin has historically dropped 75% or more during bear markets. Most portfolios built for growth become portfolios that struggle to survive.

Club Edelweiss takes a different approach. Rather than chasing maximum returns, the strategy pursues engineered resilience—delivering meaningful crypto upside while cutting worst drawdowns in half.

This is achieved through risk parity principles applied on-chain: balancing exposures across growth and inflation environments through yield-bearing stablecoins, tokenized gold, overcollateralized Swiss Franc exposure, and Bitcoin.

The goal is not to outperform in bull markets. The goal is to still be standing—and compounding—after the bears have done their damage.

Why this matters for Reserve Protocol

Club Edelweiss aligns with Reserve Protocol's mission to end inflation for developing markets while powering institutional-grade DTFs with anti-correlated defensive reserves.

Reserve enables permissionless creation of asset-backed currencies. Club Edelweiss leverages this infrastructure to create a basket token (ixEDEL) that holds diversified collateral designed to weather any economic environment.

For users in inflation-prone economies, this provides access to a stable, yield-generating asset that doesn't rely on any single currency, commodity, or protocol.

Portfolio composition

The portfolio allocates across four strategic buckets:

Swiss Franc exposure (20%) Frankencoin (ZCHF) provides overcollateralized exposure to a hard currency outside the dollar system. The Swiss Franc has historically served as a safe haven during periods of monetary uncertainty.

Tokenized gold (20%) xAUt delivers physical gold exposure on-chain. Gold serves as the portfolio's primary inflation hedge and has demonstrated low correlation to both equities and crypto assets.

Bitcoin (20%) cbBTC (Coinbase wrapped Bitcoin) captures crypto's asymmetric upside. Bitcoin remains the portfolio's growth engine while the other allocations dampen its volatility.

Yield-bearing stablecoins (40%) The stablecoin allocation splits across three yield vault positions:

- sUSDS (20%) — Sky Protocol's savings rate

- steakUSDC (15%) — Steakhouse USDC vault

- syrupUSDC (5%) — Maple Finance USDC vault

This tiered approach balances yield optimization against protocol concentration risk.

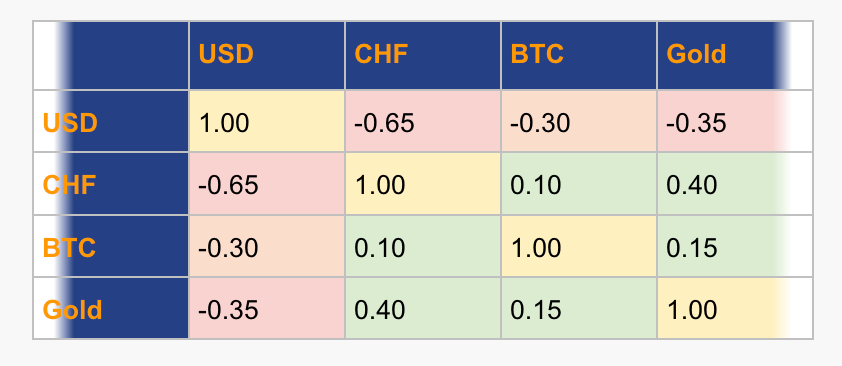

Understanding the Correlation Matrix

A correlation matrix reveals how assets move in relation to each other — the foundation of true diversification. When two assets have high correlation (close to 1.0), they rise and fall together, offering no protection when one crashes. When correlation is low or negative, one asset's decline is cushioned by another's stability or gain. The ixEDEL basket is constructed around this principle: Bitcoin and gold share a low 0.15 correlation despite both being "hard money" narratives; the Swiss franc moves inversely to the US dollar (-0.65); and yield-bearing stablecoins remain steady while volatile assets swing. This isn't accidental diversification — it's engineered resilience. The matrix below quantifies these relationships, showing why a 40% drawdown in Bitcoin doesn't translate to a 40% drawdown in the basket, and why rebalancing between uncorrelated assets generates alpha over time.

Correlation Matrix of Assets

Legend: Yellow = diagonal (variance), Green = positive, Orange/Red = negative

Volatilities (annualized): USD 6%, CHF 9%, BTC 62%, Gold 16%, ETH 85%

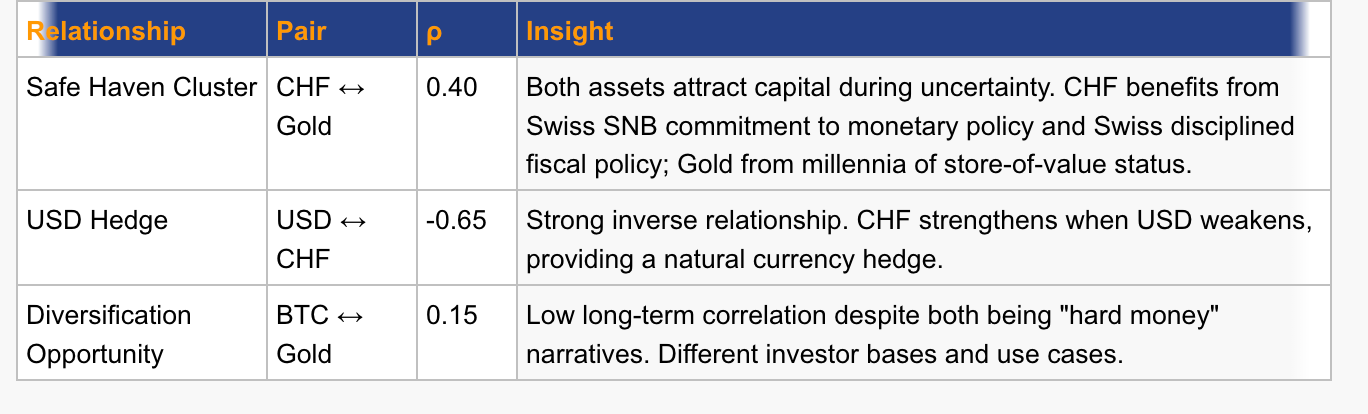

Key Relationships from the Correlation Matrix

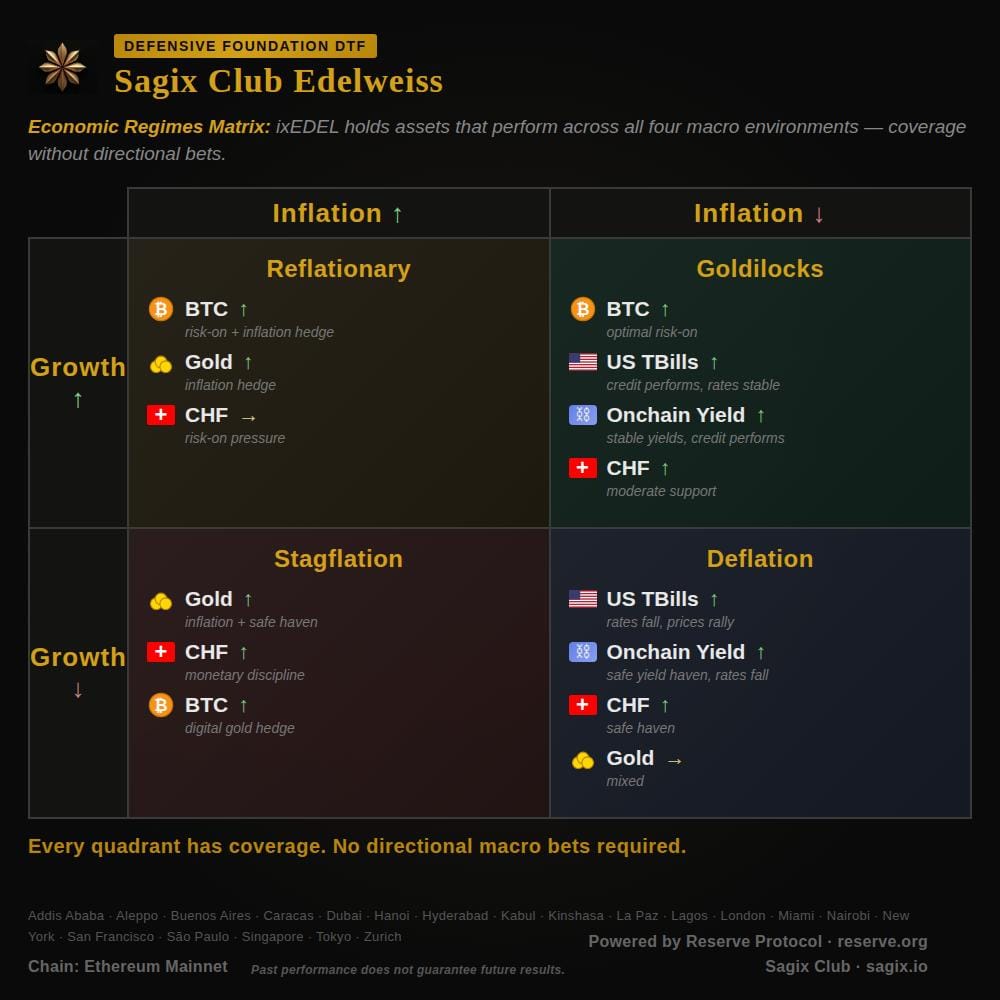

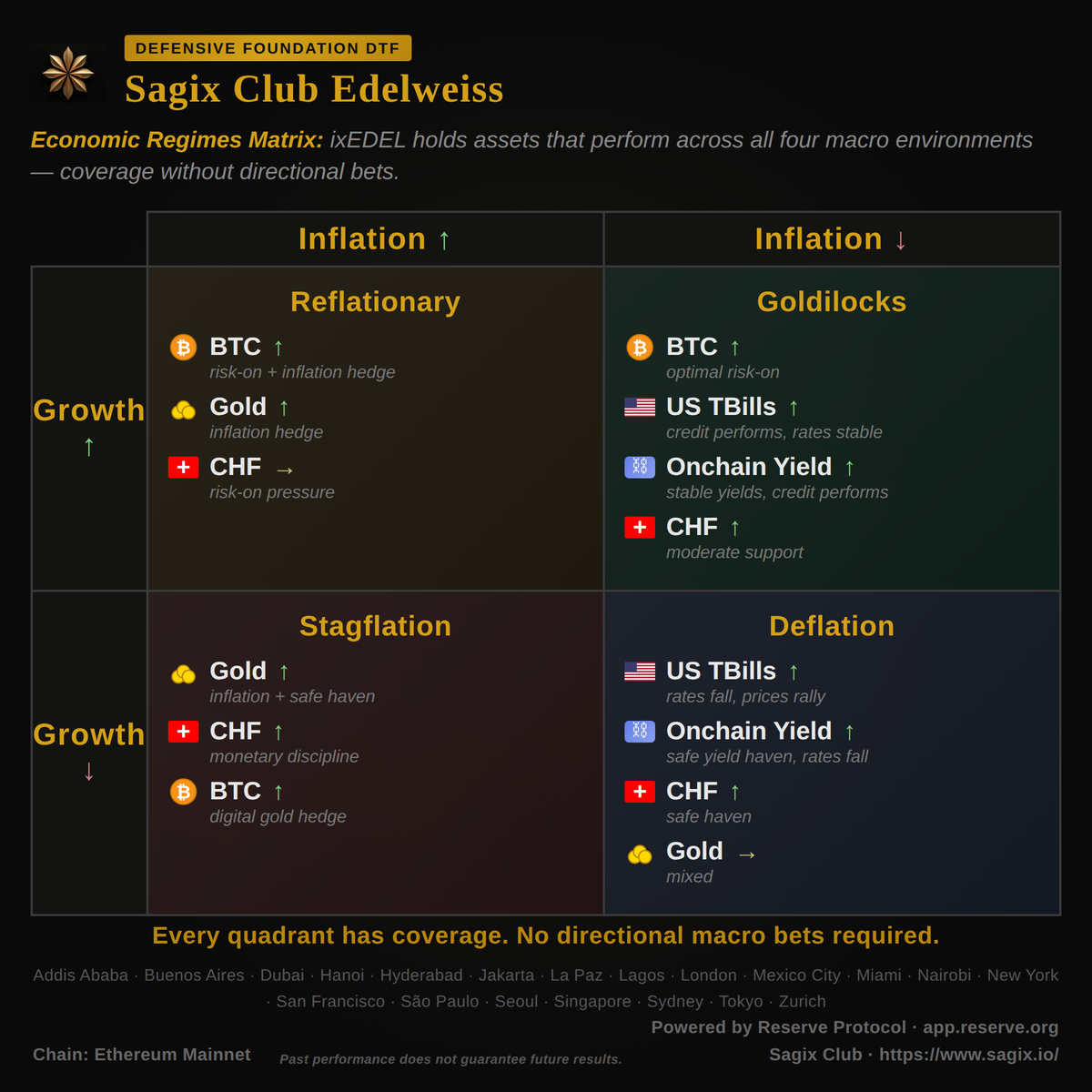

The economic regimes matrix

Traditional portfolios assume a single economic environment. Club Edelweiss prepares for four:

| Regime | Growth | Inflation | Favored Assets |

|---|---|---|---|

| Goldilocks | Rising | Falling | Equities, Growth |

| Reflation | Rising | Rising | Commodities, TIPS |

| Deflation | Falling | Falling | Bonds, Cash |

| Stagflation | Falling | Rising | Gold, Real Assets |

The portfolio's allocations are designed to ensure at least one component performs in each environment:

- Rising growth: Bitcoin captures the upside

- Rising inflation: Gold and ZCHF appreciate

- Falling growth: Stablecoin yields provide steady returns

- Falling inflation: Dollar-denominated stablecoins hold value

No prediction is required. The portfolio simply holds assets that respond differently to macroeconomic shifts.

Historical performance context

Backtesting the underlying asset allocation from 2020–2026 yields a Sharpe ratio of 1.24—indicating favorable risk-adjusted returns.

Important caveats:

- Past performance does not predict future results

- Actual DTF performance will differ due to fees, slippage, and execution timing

- The strategy has limited live track record

The Sharpe ratio suggests the diversification benefit is real, but investors should size positions appropriately for an unproven on-chain strategy.

Fund details

| Parameter | Value |

|---|---|

| Token | ixEDEL |

| Platform | Reserve Protocol |

| Network | Ethereum |

| TVL Fee | 0.30% annually |

| Mint Fee | 0.30% |

| Rebalancing | Yearly / Community Proposal Vote |

| Contract | 0xe4a10951f962e6cb93cb843a4ef05d2f99db1f94 |

Who this is for

Club Edelweiss suits investors who:

- Want crypto exposure but can't stomach 75% drawdowns

- Believe in diversification across asset classes, not just tokens

- Prefer systematic strategies over active trading

- Seek yield generation during sideways markets

- Value transparency and on-chain verifiability

The strategy is not for investors seeking maximum returns in bull markets. Those investors should hold concentrated Bitcoin or Ethereum positions instead.

Governance and transparency

As a Reserve Protocol DTF, Club Edelweiss operates with full on-chain transparency:

- All holdings are verifiable on Ethereum block explorers

- Rebalancing transactions are public

- Fee collection is programmatic, not discretionary

The portfolio manager's role is limited to setting target allocations and triggering rebalances. The protocol handles all execution.

Legal disclaimers and disclosures

Educational purpose only: This content is provided exclusively for educational and research purposes. It should not be construed as investment advice, financial planning guidance, or official economic analysis. Any contemporary parallels or strategy discussions are presented as academic analysis, not recommendations for action.

AI-assisted research disclosure: This analysis was researched and written with substantial assistance from artificial intelligence technology (Claude, Anthropic). While extensive efforts were made to verify all claims and analysis, readers should independently verify any information before relying on it for investment purposes.

Investment risk warning: Historical financial analysis does not constitute investment advice or recommendations. Past performance, whether historical or hypothetical, does not guarantee future results. All investments carry risk of loss, including total loss of principal. Cryptocurrency investments are particularly volatile and may lose significant value.

No professional relationship: This content does not create any professional, advisory, fiduciary, or client relationship between the reader and Sagix Apothecary, its authors, or affiliated entities. Readers seeking financial, investment, legal, or regulatory guidance should consult qualified professionals licensed in their jurisdiction.

DTF-specific risks: Decentralized Token Funds (DTFs) on Reserve Protocol carry additional risks including smart contract vulnerabilities, oracle failures, liquidity constraints, and regulatory uncertainty. The ixEDEL token has limited track record and may not perform as historical simulations suggest.

Liability protections: The authors, publishers, and Sagix Apothecary assume no responsibility for errors, omissions, or consequences arising from the use of this information. Users assume full responsibility for any decisions or actions taken based on this content.

Last Updated: February 2026

Publisher: Sagix Apothecary - The Genesis Address LLC