Sagix Club Ecosystem: ixAssets

Decentralized Token Folio (DTF) Product Family

Chain: ETH mainnet | Protocol: Reserve.org | Version 16.2 | January 16, 2026

1. Investment Strategy & Methodology

1.1 Investment Thesis

The Sagix Club DTF ecosystem (ixAssets) consists of a series of nested Decentralized Token Folios (DTFs) deployed on the reserve.org protocol providing diversified exposure to DeFi governance, AI infrastructure, and yield-bearing assets, anchored by a defensive defensive reserve of yield-bearing stablecoins, tokenized gold, Swiss Franc and Bitcoin.

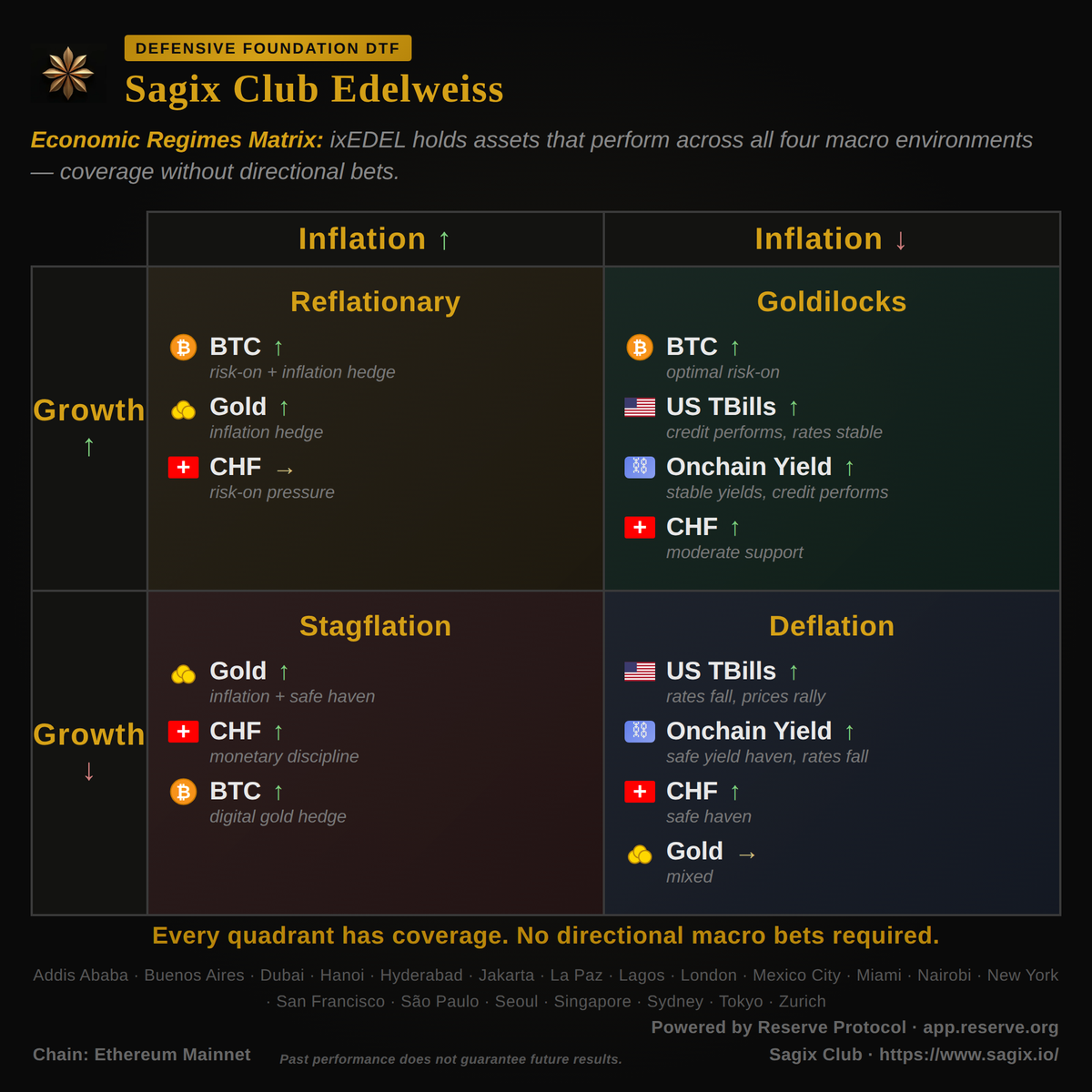

This approach draws inspiration from proven multi-asset frameworks, adapting Bridgewater's All Weather risk parity principles—which balance exposures across economic environments (growth and inflation regimes)—to the digital asset landscape. As detailed in Sagix Apothecary's analysis of modern portfolio construction, traditional diversification falls short in correlated crises, necessitating true anti-correlated pillars: growth assets (including DeFi and AI infrastructure), inflation hedges (tokenized gold and commodities), uncorrelated hard currency (Swiss Franc exposure), and defensive yield-bearing reserves.

The Sagix Club DTFs implement this resilient, environment-agnostic structure on-chain, delivering infrastructure diversification tailored for enduring crypto market cycles.

The product targets investors looking for exposure to DeFi protocols, oracle infrastructure, or AI networks. SAGIX positions itself as "Infrastructure Diversification" for sophisticated investors seeking exposure beyond concentrated BTC/ETH products.

2. ixAssets Proposed

2.1 Sagix Club Edelweiss ($ixEDEL)

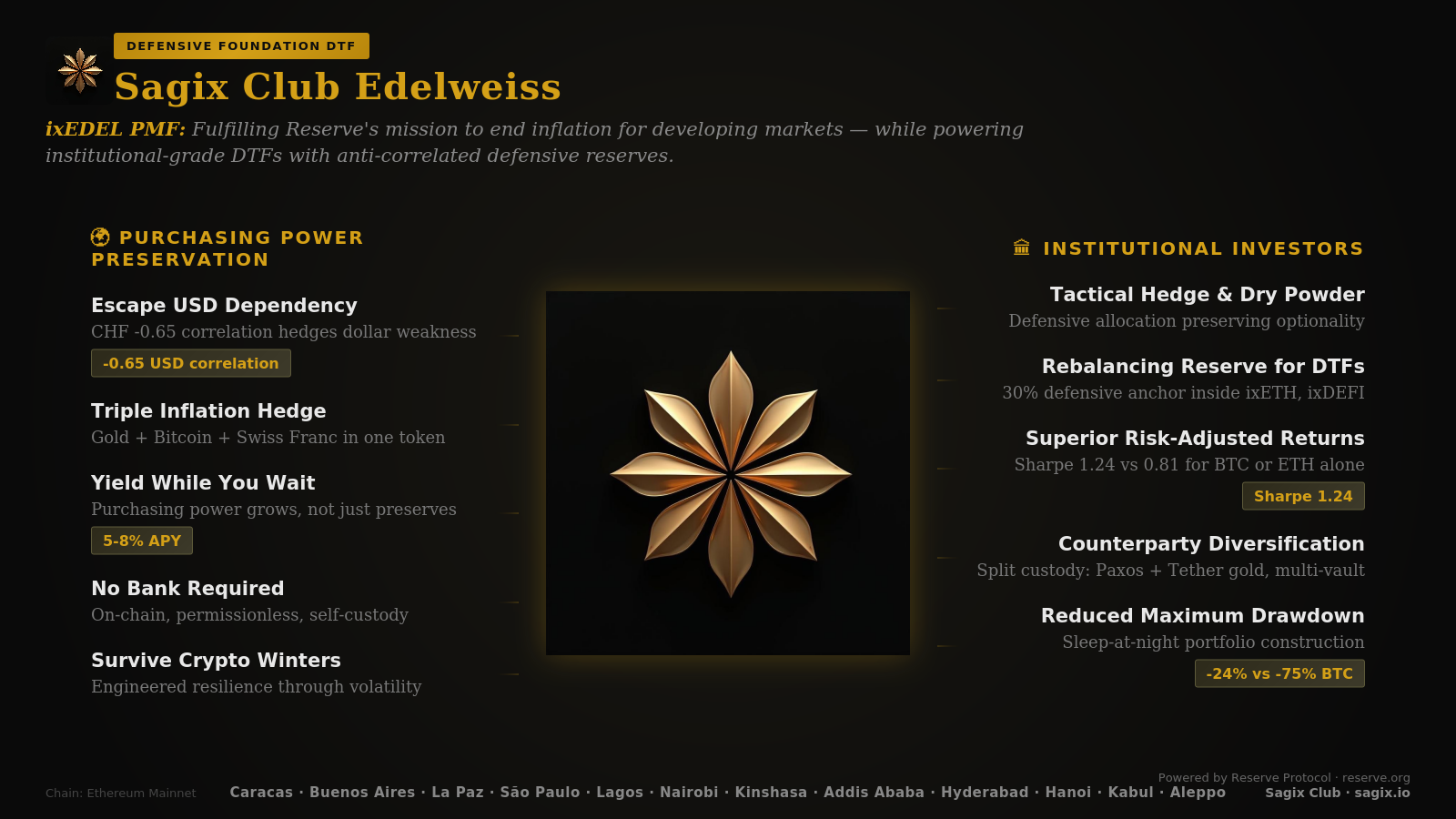

Amber seals. Edelweiss endures. ixEDEL preserves. A higher Sharpe ratio lets you sleep at night.

LIVE ON MAINNET:

https://app.reserve.org/ethereum/index-dtf/0xe4a10951f962e6cb93cb843a4ef05d2f99db1f94/overview

Mandate: Defensive Foundation DTF

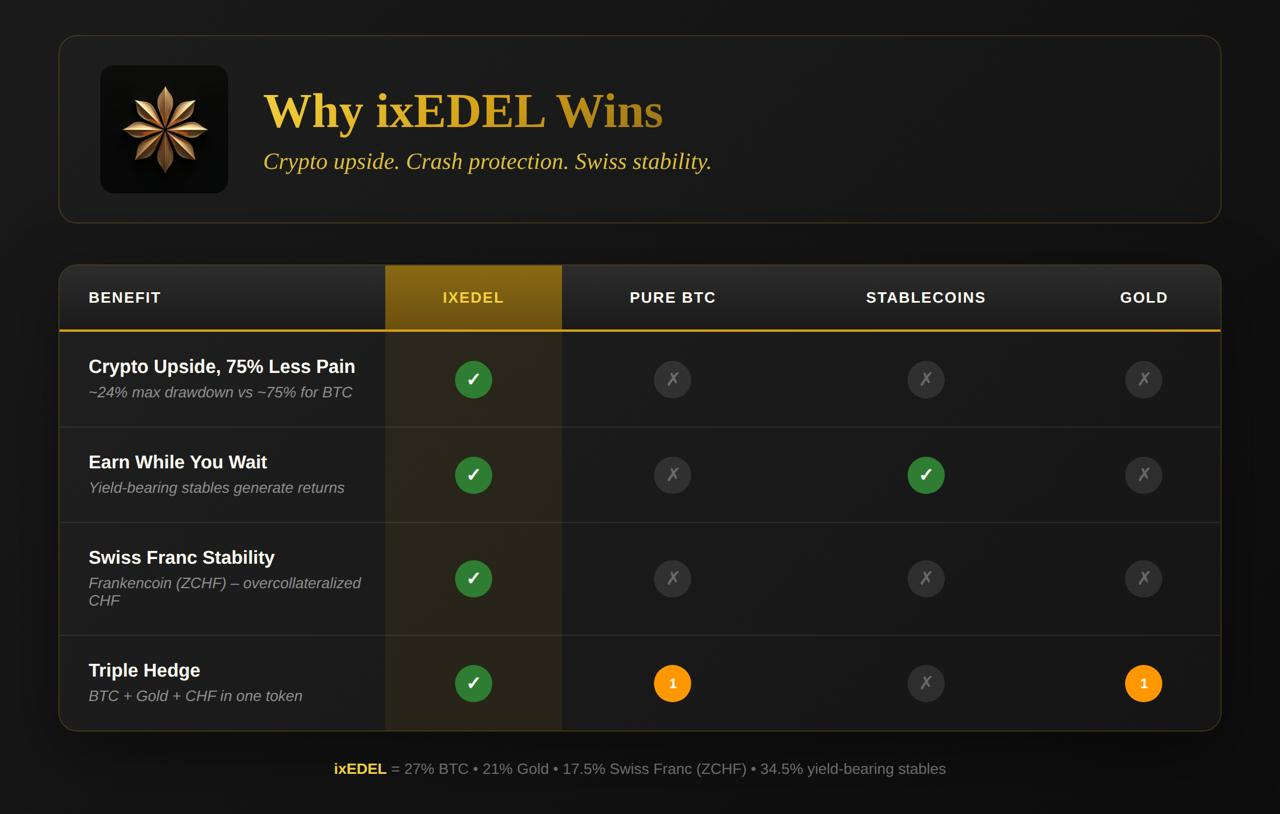

What it is: A basket combining yield-bearing stablecoins, tokenized gold, overcollateralized Swiss Franc exposure, and Bitcoin — designed to capture crypto's upside while cutting its worst drawdowns in half.

Token Holdings:

Technical Note: Frankencoin Yield

The Frankencoin team is deploying AMM pools with svZCHF soon and the plain ZCHF will soon be swappable for the yield begin svZCHF

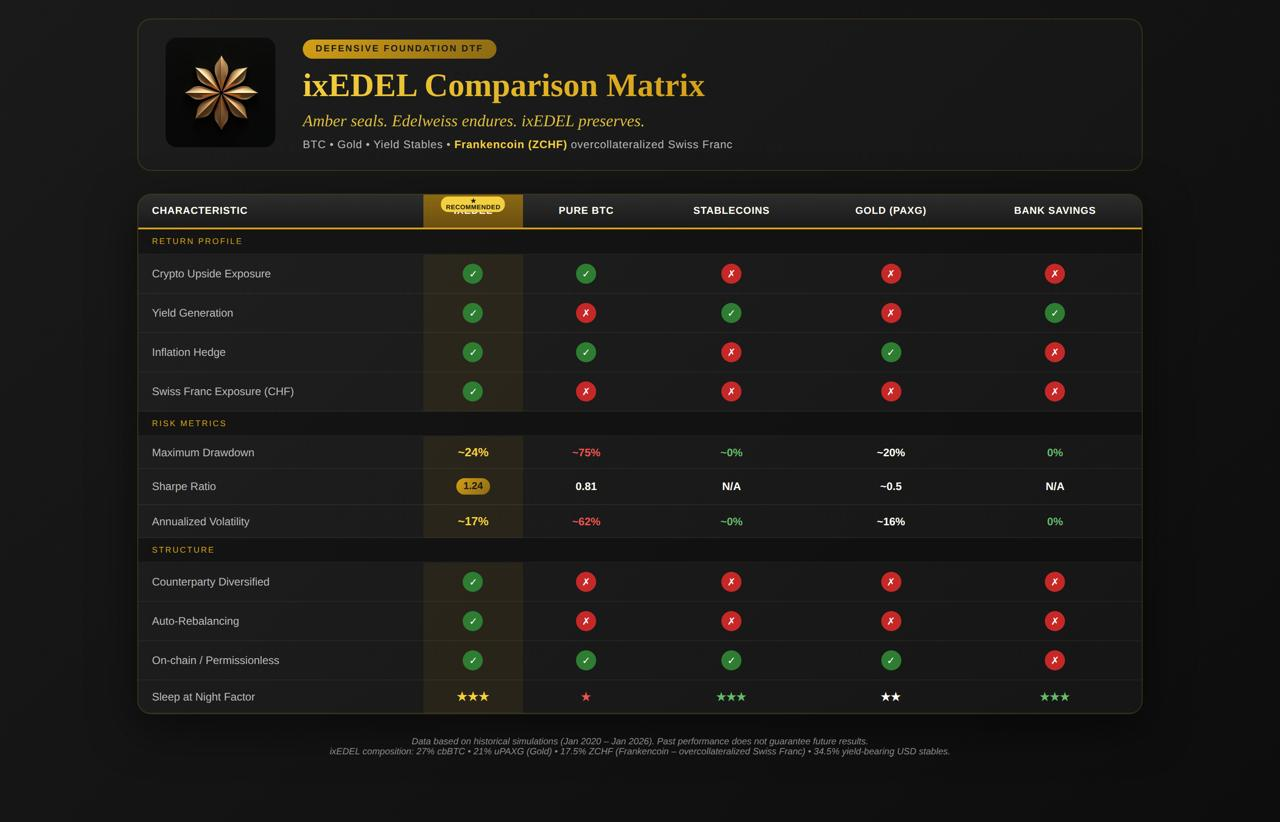

The Evolution of Cash Reserves: Holding stablecoins in a wallet earning nothing, or holding Bitcoin and suffering 75% crashes. ixEDEL sits between these extremes — delivering ~21% annualized returns with only ~17% volatility and a maximum drawdown of ~24%, compared to Bitcoin's 62% volatility and 75% drawdowns.

The trade-off: You won't match Bitcoin in a bull market. But you'll still be here after the crash. Historical simulations show a Sharpe ratio of 1.24 — meaning you earn more return per unit of risk than holding Bitcoin alone (0.81) or Ethereum (0.81).

How it works: The basket rebalances periodically, automatically selling winners and buying laggards. This locks in gains during rallies and accumulates assets during dips — enforced discipline most investors lack.

Why "Edelweiss"? The Edelweiss flower survives in the harshest alpine conditions. The name reflects what this basket is built for: surviving crypto winters while others capitulate.

Understanding the Correlation Matrix

A correlation matrix reveals how assets move in relation to each other — the foundation of true diversification. When two assets have high correlation (close to 1.0), they rise and fall together, offering no protection when one crashes. When correlation is low or negative, one asset's decline is cushioned by another's stability or gain. The ixEDEL basket is constructed around this principle: Bitcoin and gold share a low 0.15 correlation despite both being "hard money" narratives; the Swiss franc moves inversely to the US dollar (-0.65); and yield-bearing stablecoins remain steady while volatile assets swing. This isn't accidental diversification — it's engineered resilience. The matrix below quantifies these relationships, showing why a 40% drawdown in Bitcoin doesn't translate to a 40% drawdown in the basket, and why rebalancing between uncorrelated assets generates alpha over time.

Correlation Matrix of Assets

Legend: Yellow = diagonal (variance), Green = positive, Orange/Red = negative

Volatilities (annualized): USD 6%, CHF 9%, BTC 62%, Gold 16%, ETH 85%

Key Relationships from the Correlation Matrix

2.2 Sagix Club Casper Serenity ETH ($ixETH)

Finality, diversified. One decade beats one cycle.

Steady compound through every market. Stay in the game.

LIVE ON MAINNET:

https://app.reserve.org/ethereum/index-dtf/0x60105cbd0499199ca84f63ee9198b2a2d5441699/settings

VIDEO OVERVIEW FOR TL;DR https://youtu.be/dGlJ6pr8kLg

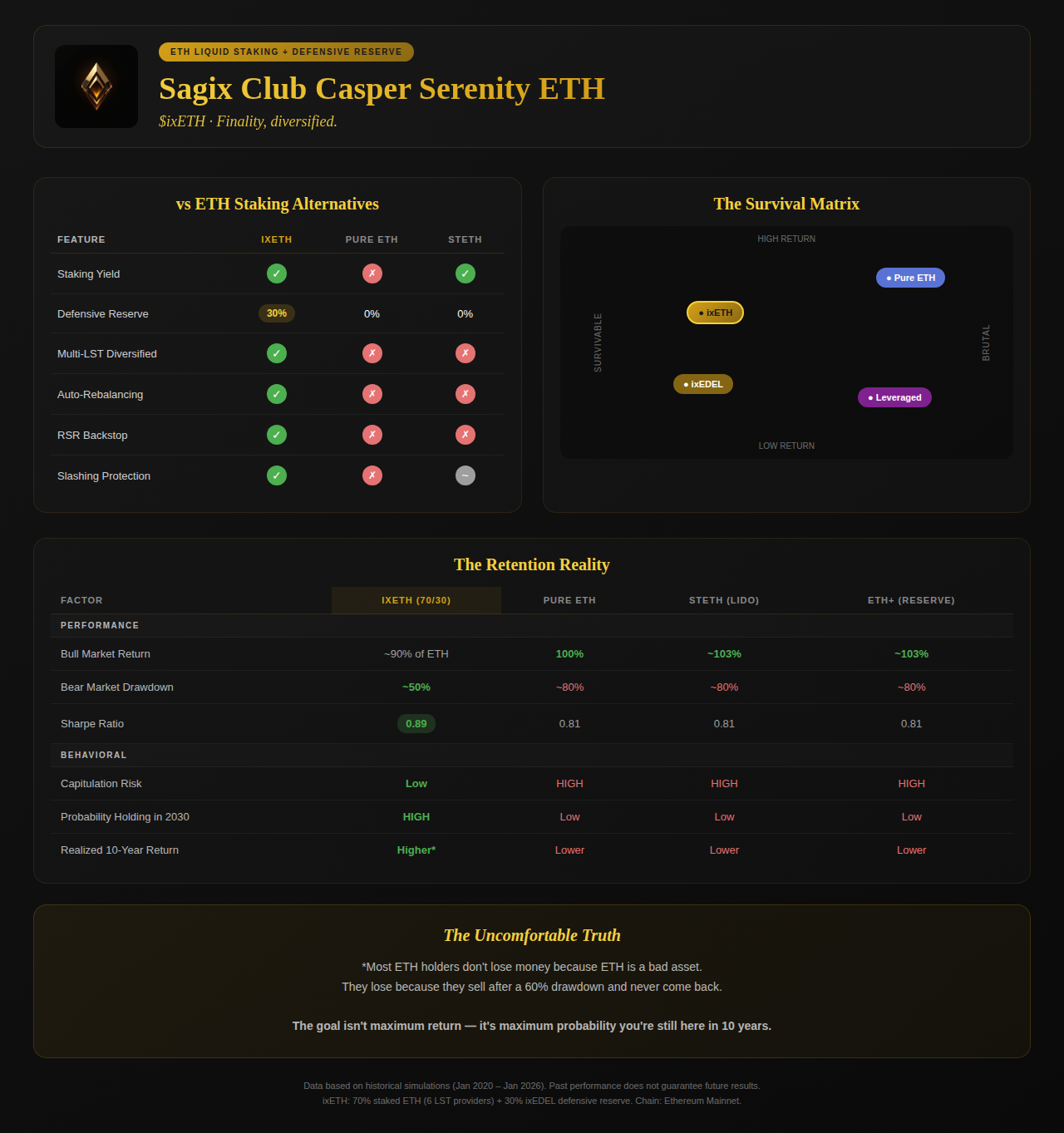

Mandate: ETH Liquid Staking Index with defensive reserve

What it is: A 70/30 blend of staked Ethereum and ixEDEL — designed to keep you in the market through the crashes that make most investors quit.

The Evolution of Ethereum Exposure: Holding pure ETH and white-knuckling through 75% drawdowns, then panic-selling at the bottom. ixETH delivers returns with lower volatility and drawdowns, compared to pure Ethereum.

Unlike 100% ETH products like stETH or ETH+ (which is a 15% component of our basket), $ixETH is a meta-strategy that positions you on the Markowitz Efficient Frontier by blending liquid staking with a 30% defensive reserve. This structural diversification targets the long-term stickiness and lower churn that single-asset yield products cannot provide, ensuring you survive the 70%+ drawdowns that typically cause investors to capitulate.

The trade-off: You'll underperform ETH in a bull market by roughly 10 percentage points. But one decade of compounding beats one bull run followed by capitulation. The goal isn't maximum return — it's maximum probability you're still here for the next cycle.

How it works: The 30% ixEDEL acts as a shock absorber and rebalancing reserve. When ETH moons, rebalancing automatically trims profits into the stable base. When ETH crashes, the reserve buys more at lower prices. It's enforced buy-low/sell-high — the discipline most investors know they need but can't execute.

Why it matters: Most ETH holders don't lose money because ETH is a bad asset. They lose because they sell after a 60% drawdown and never come back. ixETH smooths drawdowns, reducing churn, the difference between quitting crypto forever and surviving to compound another cycle.

Bottom Line: The goal isn't maximum return — it's maximum probability you're still here in 10 years. The defensive allocation costs you upside in bull markets. Staying for a decade is worth more than one moon followed by capitulation.

Understanding the correlation matrix

A correlation matrix reveals how assets move in relation to each other — the foundation of true diversification. When two assets have high correlation (close to 1.0), they rise and fall together, offering no protection when one crashes. When correlation is low or negative, one asset's decline is cushioned by another's stability or gain. The ixETH blend exploits this principle: Ethereum and the ixEDEL basket share a moderate 0.59 correlation — enough to participate in crypto's upside, but low enough that ixEDEL's gold (0.12 correlation to ETH), Swiss Franc (0.05), and stablecoin components provide genuine cushioning during crashes. When ETH drops 50%, the gold and franc holdings don't follow it down. This isn't just dilution — it's structural protection. The matrix below quantifies these relationships, showing why ixETH's drawdowns are consistently shallower than pure ETH, and why periodic rebalancing between the uncorrelated components generates alpha by systematically buying ETH when it's down and trimming when it's up.

Correlation Matrix

Legend: Yellow = diagonal (variance), Green = positive, Orange/Red = negative

Volatilities (annualized): USD 6%, CHF 9%, BTC 62%, Gold 16%, ETH 85%

Key Relationships

Methodology: Returns and volatilities calculated from weekly log returns, January 2020 to January 2026, sourced via Polygon API. Correlations derived from the same dataset. Sharpe ratios assume zero risk-free rate. Note: BTC-Gold and BTC-ETH correlations are time-varying and can shift during market stress.

Token Holdings:

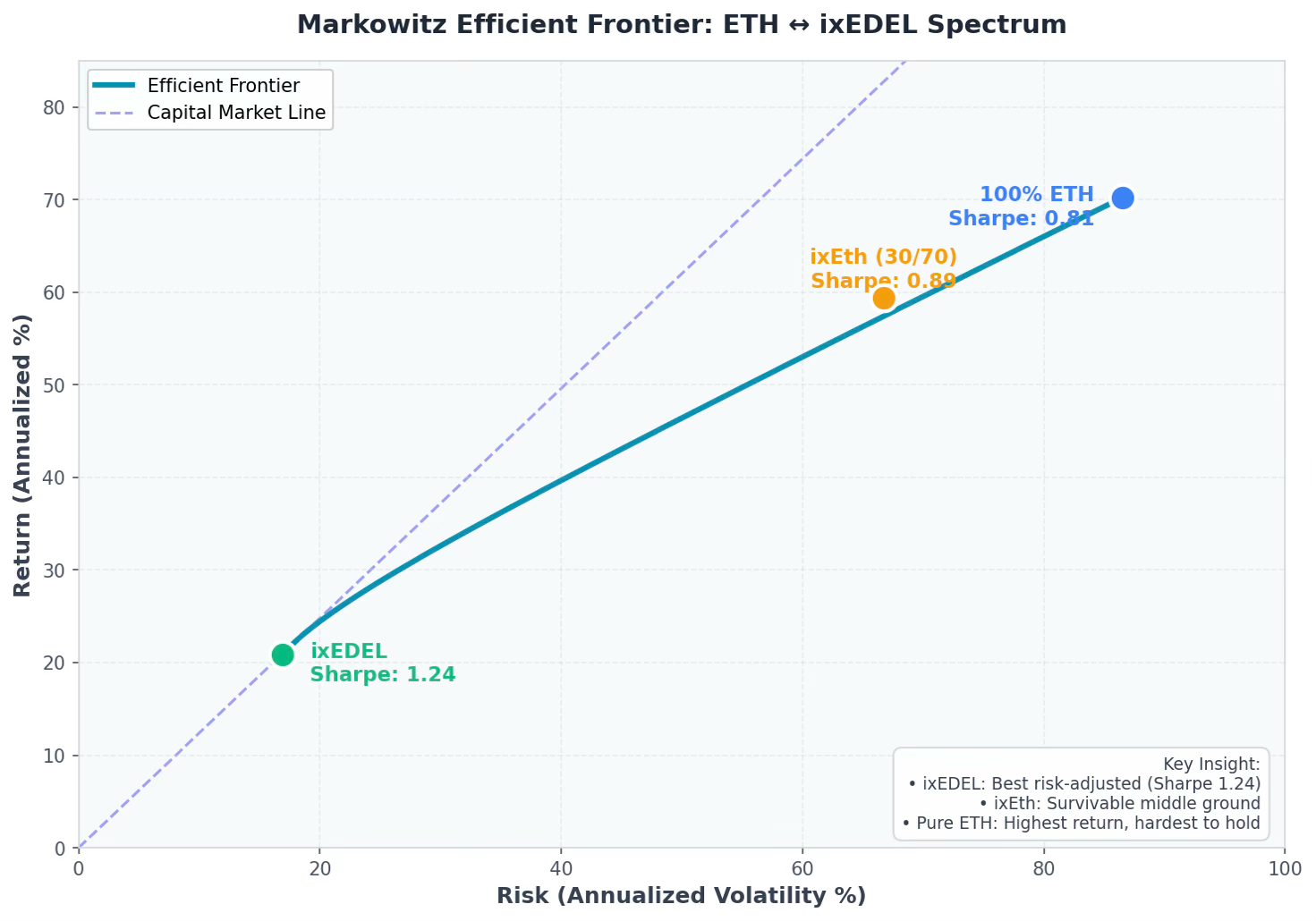

Markowitz Efficient Frontier

ETH ↔ ixEDEL Spectrum | 2020-2026 Historical Data

Portfolio Comparison

Reading the Chart

The curve represents all possible combinations of ETH and ixEDEL. Points on this frontier offer the best return for a given level of risk — you can't do better without moving along the curve.

ixEDEL (green) sits at the high-Sharpe end. It delivers the best risk-adjusted return but with lower absolute growth. This is your defensive foundation.

ixEth (orange) sits in the middle — accepting more volatility in exchange for higher returns while staying on the efficient frontier. This is the survivable compromise.

100% ETH (blue) offers the highest returns but at extreme risk. Most investors can't hold through the 75%+ drawdowns, making theoretical returns unrealized in practice.

Key Insight

Moving from ETH to ixEth, you sacrifice ~10% return to reduce risk by ~20%. Moving from ixEth to ixEDEL, you sacrifice ~38% return to reduce risk by another ~50%. Pick your point based on what drawdown you can survive, not what return you dream about.

The question isn't which product has the best returns. It's which drawdown you can hold through without capitulating. One decade of compounding beats one bull run followed by panic selling.

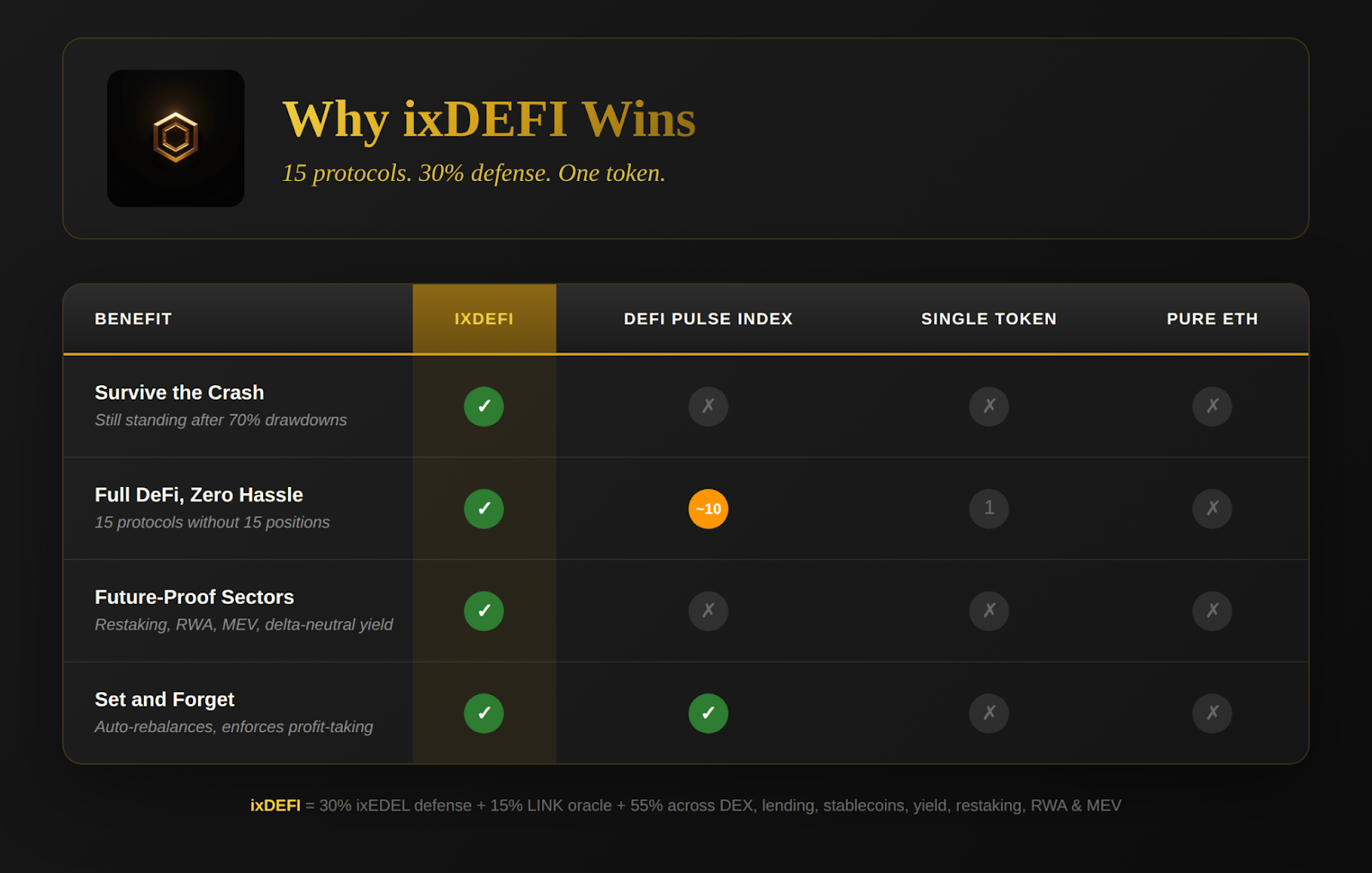

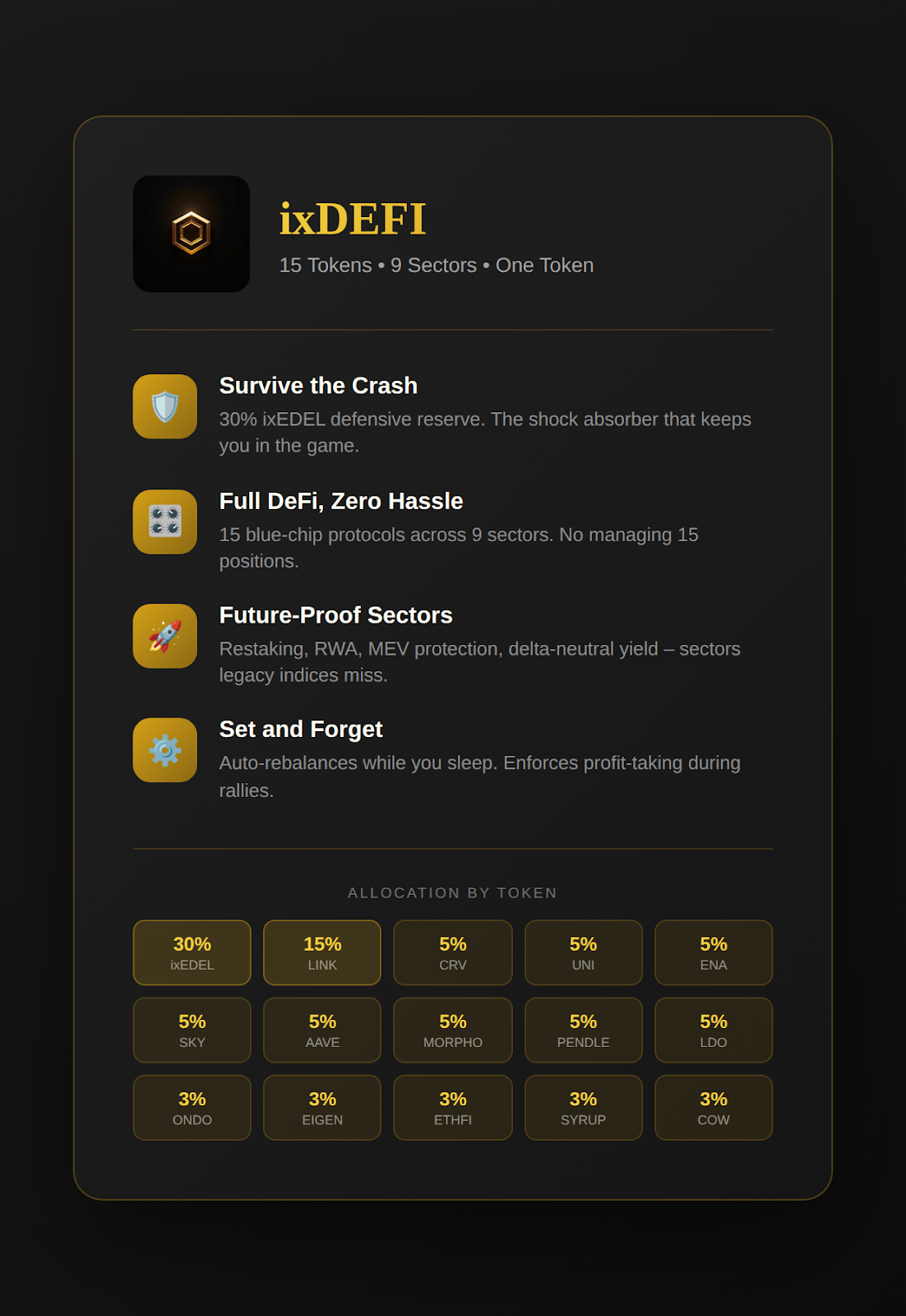

Sagix Club DeFi ($ixDEFI)

Balance through every market condition

Mandate: DeFi Protocol Index with Defensive defensive reserve | 15 Tokens | TVL Fee: 0.75%

Sector Exposure Check

The ixDeFi DTF represents a Barbell Strategy. On one end, we have 45% in extremely liquid, blue-chip assets (LINK, AAVE, UNI, LDO, SKY) that wecan exit instantly. On the other end, we have 15% in high-yield, newer protocols (ETHFI, SYRUP, EIGEN, ONDO, COW) that carry higher liquidity risk but offer massive growth potential.

- Lending & Stablecoins (28%): AAVE, SKY, MORPHO, ENA, SYRUP, CRV.

- Infrastructure & Oracles (15%): LINK.

- Staking & Restaking (11%): LDO, EIGEN, ETHFI.

- Exchanges & MEV (11%): UNI, PENDLE, COW.

- Real World Assets (3%): ONDO.

- Defensive DTF (30%): ixEdel.

Token Holdings:

Investment Philosophy - Sagix.io Content Platform

The deployer operates Sagix Apothecary (sagix.io), an established investment research platform providing institutional-grade analysis. The platform demonstrates deep expertise in DeFi protocols, tokenomics, and portfolio construction—directly relevant to SAGIX Club DTF management.

Platform Philosophy: "Ancient wisdom for modern DeFi." Sagix Apothecary crafts sophisticated portfolio strategies by applying centuries of financial wisdom to decentralized finance. The platform synthesizes research from Federal Reserve economists, academic journals, and authoritative historical sources to provide institutional-grade analysis.

Flagship Content Series:

- The Druid Deep Dive: Long-form research exploring pivotal moments in monetary history—from America's 1837 free banking experiment to Brazil's 1980s hyperinflation crisis—revealing direct parallels to modern DeFi protocols.

Published Research (2025):

Platform: sagix.io | @sagixapothecary (X/Twitter, TikTok, YouTube, Instagram)

──────────────────────────────────────────────────────────────────

Sagix Club is a trade name of The Genesis Address DAO LLC

Contact: @sagixapothecary on X/Twitter | Website: sagix.io

Version 16.1 — January 12, 2026