Slow and steady wins the race: Ancient fables meet modern DeFi investing

Why leverage, yield chasing, and concentration destroy crypto portfolios while diversification, position sizing, and long-term holding build wealth. Apply timeless Hare and Tortoise wisdom to DeFi investing for resilient returns in volatile markets.

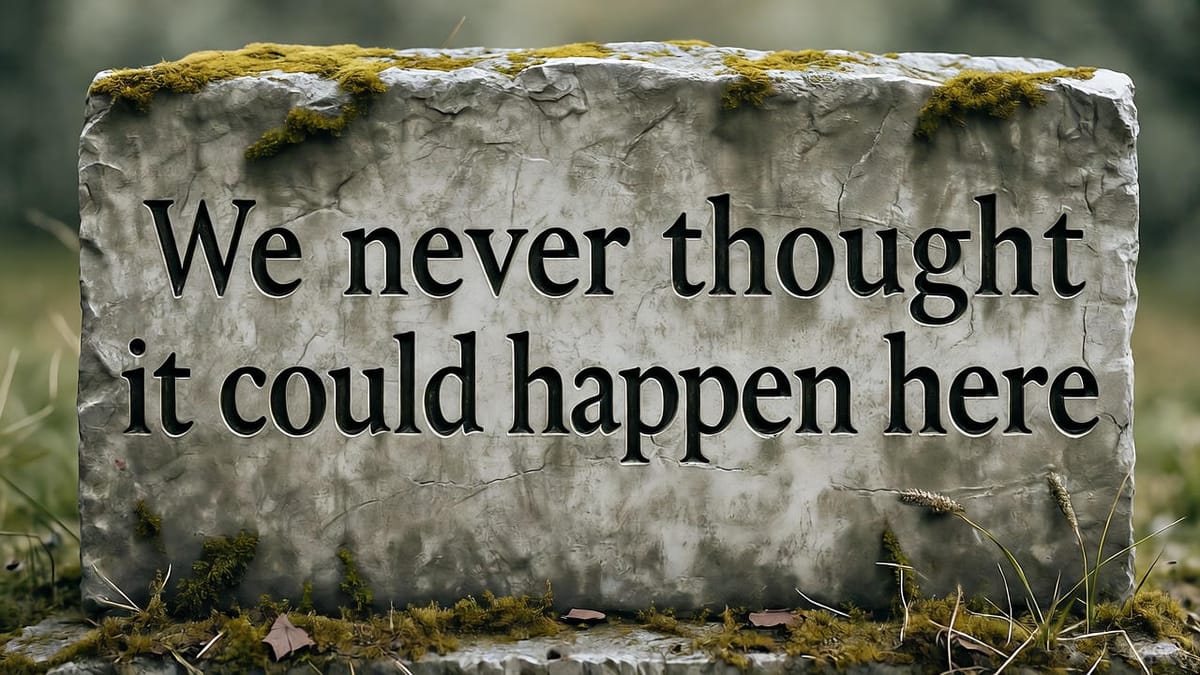

In the fast-paced world of decentralized finance, where fortunes appear and vanish in moments, timeless wisdom often provides the steadiest guide. The classic fable of the Hare and the Tortoise captures an eternal truth about investing: overconfidence and haste lead to ruin, while patience and discipline compound into lasting wealth.

This article examines why "hare-like" investing—characterized by leverage, yield chasing, and concentration—typically ends in catastrophe, while "tortoise" principles of diversification, position sizing, and long-term holding build resilient portfolios capable of weathering any market storm.

The hare's hubris: The dangers of leverage in volatile markets

The hare represents the overconfident investor who amplifies bets with leverage, chasing rapid gains while inviting catastrophe. Leverage magnifies both profits and losses, turning minor corrections into devastating wipeouts.

In traditional finance, the 2008 financial crisis demonstrated this brutal arithmetic. Leveraged mortgage-backed securities led to trillions in global losses as institutions like Lehman Brothers collapsed under debt burdens they assumed were safe.

The mathematics of leverage creates asymmetric risk: a 50% loss requires a 100% gain just to break even. But with leverage, even modest declines can trigger complete liquidation before any recovery becomes possible. During the 2022 crypto market crash, leveraged positions contributed to $40 billion in losses as cascading liquidations amplified the downturn.

Path dependency and borrowing costs

Leverage introduces path dependency risk, where the sequence of returns matters as much as the average return. Two portfolios with identical average returns can produce vastly different outcomes when one employs leverage—because the leveraged portfolio may not survive long enough to realize the average.

Even modest leverage like 1.2x introduces decay in flat markets due to borrowing costs. The fees accumulate silently during sideways action, eroding capital while providing no benefit. When volatility finally arrives, the weakened position faces liquidation at precisely the worst moment.

Studies show Bitcoin's correlation with equities rises dramatically during crashes, reaching 0.87 in recent market stress events. This means leveraged crypto positions lose diversification benefits exactly when they're most needed—turning what seemed like independent bets into correlated disasters.

Chasing yields like the hare: High returns often hide higher risks

The hare's pursuit of flashy high-APY opportunities typically ends where most chases do—in exhaustion and defeat. High yields aren't free money; they're compensation for risk that may not be obvious until it materializes.

In traditional markets, dividend yields above 8-10% frequently signal distressed companies about to cut payouts or declare bankruptcy. The yield looks attractive until the payout disappears entirely, taking the principal with it.

In fixed income, reaching for yield by extending maturities exposes portfolios to interest rate risk. A 1% rate increase can cause 10-20% losses in long-duration bonds—the "free" extra yield evaporates in a single rate move.

The illusion of sustainable high yields

Crypto yield farming epitomizes this trap. Protocols offering 150% APY often rely on unsustainable mechanisms—new deposits paying old depositors, inflationary token emissions, or leverage structures vulnerable to volatility.

Research on diversified portfolios shows reasonable expected yields: 2-3.5% from equities, 3.5-5% from bonds. These modest figures reflect reality. When offered 50% or 150% yields, ask yourself: where is this coming from? Usually, the answer is "from the next depositor" or "from token inflation"—neither of which lasts.

Behavioral biases compound the problem. Optimism leads us to overlook default risks. Recency bias makes recent high yields seem sustainable. Authority bias makes us trust protocols simply because others have invested. Each bias nudges us toward the cliff edge.

During the 2020 oil price collapse, high-yield energy bonds saw spreads widen dramatically as companies faced bankruptcy. Investors who chased the yields for years lost everything in weeks.

Concentration risks: Why putting all eggs in one basket spells doom

The hare's all-in bets highlight perhaps the most dangerous mistake in investing: concentration risk. Statistics reveal the brutal truth: 40% of stocks suffer permanent 70%+ declines relative to the market over their lifetimes.

Historical data shows 75% of individual stocks underperform the market over long periods, while 50% deliver negative or sub-2% returns. The mathematics are unforgiving—picking winners consistently is extraordinarily difficult, but picking losers is common.

The illusion of crypto diversification

In crypto, holding 20 different tokens might seem diversified. During bull markets, this feels sophisticated. During crashes, the illusion shatters—Bitcoin and altcoins often move in tandem, with correlations exceeding 0.8.

The dot-com bubble demonstrated this perfectly. Investors who held five different tech stocks thought they were diversified. When the bubble burst, those portfolios plummeted 80% because all holdings collapsed together. Meanwhile, truly diversified portfolios recovered faster because their losses were contained.

In DeFi, protocol-specific risks add another layer of concentration danger. Smart contract exploits can wipe out positions overnight. Regulatory actions can render tokens worthless. Team decisions can crater valuations. None of these risks are diversified away by holding multiple crypto assets—they're endemic to the entire space.

During the COVID-19 market drop, concentrated growth stock portfolios fell harder than broad indices. The hare's sprint turned into a stumble, while the tortoise's steady pace continued forward.

The tortoise's toolkit: Position sizing and true diversification

The tortoise succeeds through systematic risk management, not brilliance or speed. The strategies are almost boring in their simplicity—which is precisely why they work.

Position sizing: The foundation of survival

Position sizing limits any single holding to 5% of the portfolio, preventing one failure from causing ruin. This seemingly simple rule embodies profound wisdom: you cannot compound returns if you've been eliminated.

The mathematics support this approach. A diversified portfolio with 20 positions, each at 5%, can withstand multiple failures while maintaining the ability to recover. A concentrated portfolio with three positions at 30% each faces catastrophic risk from any single mistake.

True diversification spans asset classes

Real diversification requires holdings across genuinely uncorrelated assets:

- 50+ stocks across 8+ sectors

- Multiple geographies and markets

- Bonds with varying durations and credit qualities

- Real assets like REITs

- Carefully vetted crypto exposure (not 20 correlated tokens)

This structure reduces volatility by 20-30% without sacrificing returns, according to modern portfolio theory. The reduction in volatility isn't just comfort—it prevents the behavioral mistakes that destroy returns during market stress.

Quality over hype

The tortoise favors boring investments with stable fundamentals over exciting narratives. Index funds have historically outperformed active strategies 85% of the time over 10-year periods—not because they're clever, but because they avoid the mistakes that sabotage performance.

In crypto, this means favoring established protocols with real utility, transparent teams, and battle-tested code over the latest "revolutionary" project promising 1000x returns.

Time in the market trumps timing: Enduring storms like the tortoise

The tortoise's steady pace embodies perhaps the most powerful principle in investing: time in the market beats timing the market.

Attempts to time peaks and troughs consistently fail. Research shows that missing just the best 10 days in a decade can halve returns. From 1928-2023, the S&P 500 averaged 9.6% annually—but only for those who remained invested through volatility.

Crypto winters test conviction

Bitcoin's history demonstrates this principle clearly. Holders who endured the cycles saw thousand-percent gains. Those who tried to time entries and exits typically sold low and bought high, destroying their returns through trading costs and poor timing.

Volatility drag from frequent trading reduces returns by 1-2% annually—a silent but devastating tax on impatience. The mathematics of compounding work powerfully over time, but only for capital that survives.

Long-term data shows that bear markets—defined as 20%+ drops—typically resolve within 1-3 years. The tortoise who remains invested through the storm is positioned perfectly for recovery. The hare who panicked and sold locks in losses permanently.

The 2022 crypto bear market eliminated countless "hares" who chased yields and used leverage. Meanwhile, "tortoises" with diversified positions, reasonable sizing, and no leverage simply endured—surviving to participate in eventual recovery.

Cognitive traps: Why we fall for the hare's allure

Understanding why hare-like behavior is so common requires examining the cognitive biases that drive it.

Overconfidence bias makes us believe rules don't apply to us. Yet 90% of active traders lose money—the data is unambiguous, but each new participant believes they'll be different.

Recency bias causes recent events to dominate our perception while historical patterns fade. After a bull run, crashes seem impossible. After stability, volatility seems gone. We forget the S&P 500 fell 55% during 2007-2009 because it recovered years ago.

Hindsight bias convinces us we could have predicted or timed market moves perfectly. Looking backward, patterns seem obvious. But in real-time, with money at stake, those patterns are invisible amid noise.

Optimism bias leads us to overestimate positive outcomes while discounting risks. "That won't happen to me" is the anthem of future casualties.

Countering these biases requires systematic discipline: rules-based investing, regular rebalancing regardless of emotions, and relentless focus on capital preservation over return maximization.

Applying tortoise wisdom to DeFi: Building resilient portfolios

In DeFi's chaotic environment, tortoise principles become even more critical:

Avoid unnecessary leverage. If you need leverage to make acceptable returns, your base strategy is flawed. Accept lower returns in exchange for survival.

Question unsustainable yields. When protocols offer triple-digit APYs, understand exactly where that yield originates. If you can't explain the mechanism, you can't assess the risk.

Diversify beyond crypto. Holding multiple tokens isn't diversification if they all collapse together. True diversification requires exposure to assets that don't share crypto's systemic risks.

Size positions conservatively. No single position should threaten your portfolio's viability. The "opportunity of a lifetime" arrives regularly—but only for those with capital remaining to seize it.

Favor established protocols. Boring, battle-tested infrastructure beats exciting new experiments that haven't survived market stress.

Hold through volatility. During market shakes, tortoises survive while hares get liquidated. Capital preservation enables participation in recovery.

Historical precedents

The pattern repeats throughout financial history. The 1987 crash saw 22% single-day drops, but long-term holders thrived. Crypto's 2018 winter preceded the 2021 bull run. Those who maintained positions and added during fear captured the recovery gains. Those who panicked and sold low missed it entirely.

Conclusion: Embrace the tortoise for lasting wealth

The Hare and the Tortoise endures as a fable because it captures eternal truths about human nature and success. Hubris leads to spectacular falls. Patience leads to quiet victory.

In DeFi's volatile arena, the lesson is unambiguous:

- Shun leverage that turns corrections into catastrophes

- Ignore yields that are too good to be true

- Abandon concentration that puts all eggs in one basket

- Embrace position sizing that ensures survival

- Build true diversification across uncorrelated assets

- Stay invested through volatility rather than timing markets

The hare's sprint attracts attention. The tortoise's steady pace builds wealth. Because in markets as in fables, survival ensures you're present to participate in victory.

The race doesn't go to the swift—it goes to those still running when the swift have exhausted themselves.

Disclaimers

Educational purpose only: This content is for educational purposes and does not constitute financial, investment, or legal advice. Sagix Apothecary provides analysis drawing from timeless principles, but all decisions are your own. Always conduct your own research and consult professionals before making financial decisions.

Risk warning: Cryptocurrency and DeFi involve significant risks, including total loss of capital. Past performance does not indicate future results. All investments carry risk.

AI-assisted content: This analysis was prepared with AI assistance (Claude, Anthropic). While efforts were made to ensure accuracy, readers should independently verify information before relying on it.

No professional relationship: This content does not create any advisory or fiduciary relationship. Readers seeking professional guidance should consult qualified professionals licensed in their jurisdiction.

Liability: The authors and Sagix Apothecary assume no responsibility for errors, omissions, or consequences arising from use of this information. Users assume full responsibility for any decisions based on this content.