Can currency be backed by intelligence?

Can currency be backed by intelligence instead of gold? Bittensor's proof-of-intelligence where AI production creates value. Learn how Dynamic TAO distributes 7,200 TAO daily across competing subnets, December 2025 halving impact, allocation frameworks balancing security with growth.

The Bittensor case for Proof-of-Intelligence

From mining ore to mining minds—how TAO redefines monetary value

What is Bittensor

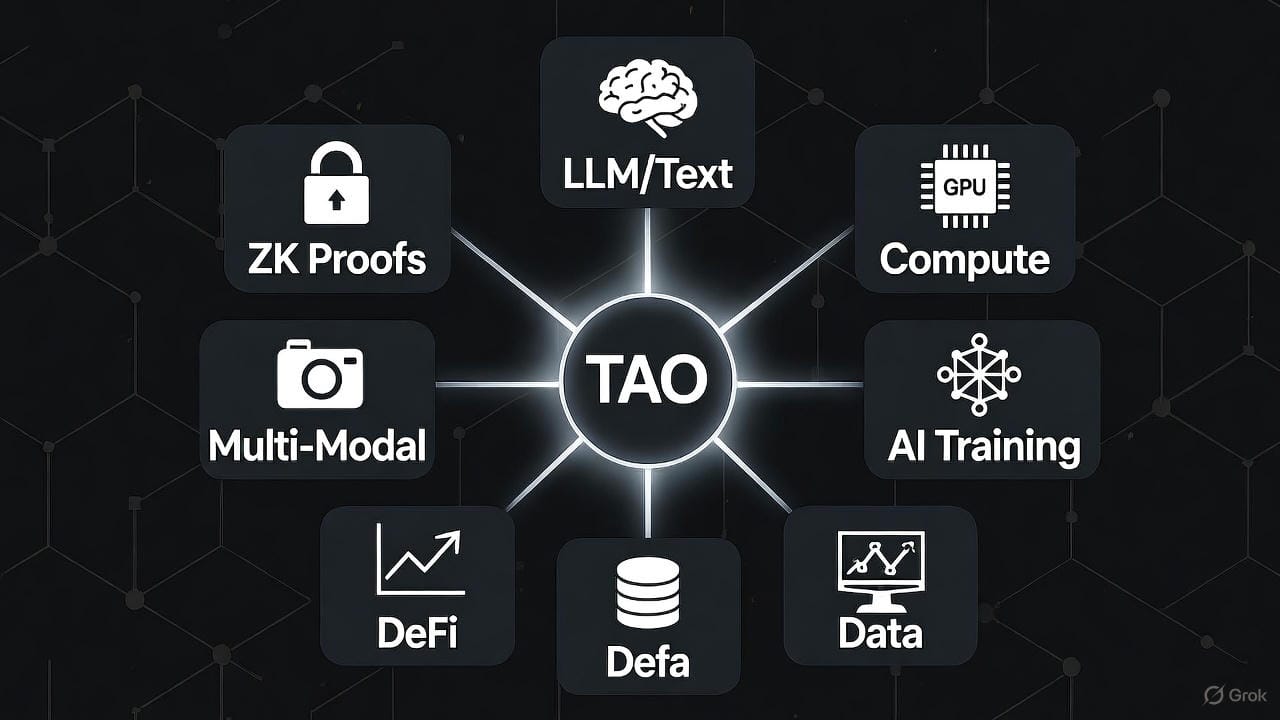

Bittensor is a decentralized network designed to produce, validate, and monetize artificial intelligence commodities through market competition. It functions as a global, permissionless marketplace where specialized AI services—ranging from compute power to language models to zero-knowledge proofs—compete for capital allocation based on their demonstrated utility and market demand.

To engage with the Bittensor network is to participate in a grand experiment built on economic principles, scarcity shocks, and a relentless, decentralized drive toward optimal intelligence. The role of any serious participant is to study the flow of energy, understand the anatomy of the network, and evaluate allocation opportunities according to observable core principles.

This compendium outlines fundamental principles for evaluating the network, the economic rules that govern its pulse, and the anatomical components that create its intelligence.

Founders and core contributors

Bittensor was co-founded by Ala Shaabana, a former Assistant Professor at the University of Toronto, and Jacob Robert Steeves, a former Google software engineer. Supported by the Opentensor Foundation (@opentensor), the team includes contributors like Yuqian Hui and François Luus.

The Bittensor whitepaper was signed by “Yuma Rao,” a mysterious, pseudonymous figure akin to Bitcoin’s Satoshi Nakamoto, whose true identity remains unknown. The official site is bittensor.com.

Part I: The anatomy of intelligence—structure of the network

Bittensor is a network of specialized, competing, and collaborating marketplaces. To understand how this network produces "intelligence," we must dissect its anatomy into three core components:

1. The Subnet (The Crucible)

The Subnet is the arena, the "alchemical crucible"—a self-contained marketplace designed to solve one specific problem (e.g., decentralized compute, code generation, financial prediction). Each subnet is a set of rules for a competition, defining the digital commodity to be produced and the incentive mechanism for producing it.

Think of subnets as specialized branches of a great tree, each developing its own unique solution to a particular AI challenge. While the Root Network (SN0) serves as the secure trunk providing governance and security, the subnets are where innovation and specialization flourish.

2. The Miner (The Producer)

The Miners are the alchemists at the workbench—the supply side of the marketplace. Their function is to provide the commodity demanded by the subnet. They are in constant, fierce competition with each other to create the highest-quality answer to the subnet's problem. This relentless, profit-driven competition forces the commodity's quality to improve exponentially.

Key characteristics:

- Provide computational resources, AI inference, or specialized services

- Compete based on quality, speed, and cost-efficiency

- Rewarded proportionally to their performance as judged by validators

- Must continuously improve to maintain competitive position

3. The Validator (The Arbiter)

The Validators are the arbiters of the competition—the judges, auditors, and "scryers" who determine the quality of the Miners' work. They are the demand side and the gatekeepers.

Key functions:

- When a user wants to use a subnet's service, the request is sent through a Validator

- Validators assess miner performance and distribute rewards accordingly

- Rewarded for honesty and accuracy

- A validator that accurately identifies and rewards high-quality miners (and punishes low-quality ones) earns more TAO for itself and for its stakers

This three-part system is the engine of Bittensor—a "Proof-of-Intelligence" loop that incentivizes a global network to verifiably create, validate, and improve useful intelligence.

Why decentralized AI may prevail

A synthesis of strategic advantages as documented in The Incentive Layer - A Bittensor Documentary

The documentary is great for understanding Bittensor and the Druid highly recommends you watch it in full. Some of the key parts are highlighted here for educational purposes, but take the time to watch it.

Bittensor represents more than a technical innovation—it embodies a fundamental philosophical position that decentralized AI infrastructure will structurally outperform centralized alternatives. The network's architecture creates compounding advantages across five critical dimensions:

1. Aligned incentives drive superior outcomes

The Bittensor network functions as an incentive alignment engine that harnesses natural market forces to ensure continuous improvement. By establishing transparent competition among thousands of participants, the quality of intelligence produced constantly increases through pure economic pressure.

"Aligned incentives and open competition. Those two principles produce superior outcomes to what can be achieved through traditional centralized organizations."

— Sami Kassab, Managing Partner at Unsupervised Capital, X: @Old_Samster

This mechanism ensures that "good is never good enough"—the network attracts higher-quality engineers who are incentivized to work harder and longer than those in traditional corporate structures, precisely because their compensation is directly tied to the measurable quality of their output rather than organizational politics or tenure.

2. Permissionless scaling eliminates gatekeepers

Traditional AI deployment requires negotiating with centralized cloud providers, obtaining account approvals, and navigating complex contracts. Bittensor offers elastic, market-driven scaling that removes these logistical and financial barriers entirely.

"To go to Amazon or Google, you're going to have to go talk to an account rep, you're going to have to get it approved… It's really difficult to do. On Bit Tensor, you just go deploy your app, you start using it, the miners will scale it up. You don't have to ask anyone for permission you just deploy it and it's purely market driven…"

— Jon Durbin, founder and primary contributor to Chutes, a serverless AI compute subnet (SN64) on Bittensor, X: @jon_durbin

This permissionless resource access creates fundamental advantages for builders who can deploy applications and watch them scale organically based on demand, without requiring institutional relationships or approval processes.

3. Global merit-based talent pool

The network completely removes traditional hiring barriers—educational credentials, geographic location, work history—by measuring contribution strictly on merit: the quality of the output.

"It completely decouples your CV with your quality of output… it's just purely it's you it's code and it's a leaderboard. Doesn't matter where you're from, what your background is. I think that is essential because it means that we're measuring things properly."

— Jack Foster, CTO (Asset Production) and Co-Founder of Tensora Group, a company focused on decentralized AI asset management within the Bittensor ecosystem, including mining, validation, and subnet incubation

This approach unlocks global brain power that centralized organizations cannot access, accumulating more resources and talent than any single company could hire through conventional means. The world's brightest minds can contribute regardless of whether they have Stanford credentials or Silicon Valley proximity.

4. Innovation velocity through distribution flywheel

The decentralized structure accelerates the pace of innovation through immediate community validation and resource allocation. With the Dynamic TAO upgrade, the community itself decides which subnets (projects) receive funding, creating a feedback loop where valuable ideas instantly gain traction.

"The pro is that you immediately get traction 'cuz the community gets excited if you're building something interesting and your products get users much faster than they would otherwise so you have this strong distribution flywheel."

— Parshant Utam, founder of ΩLabs (Omega Labs) and associated with Bittensor Subnets 21 and 24, X: @parshantdeep

This distribution advantage means that promising innovations can achieve product-market fit and user adoption far faster than in traditional venture-backed models, where builders must convince individual investors rather than demonstrating value to an open market.

5. Ethical defense against AI centralization

The philosophical foundation rests on a critical observation from the social media era: allowing a handful of corporations to control transformative technology produces negative outcomes—censorship, algorithmic manipulation, extraction rather than value creation.

"The lesson I feel like that can be learned from the last decade is that critical technology being controlled by a few corporations does not lead to good outcomes." — Sami Kassab, Managing Partner at Unsupervised Capital, X: @Old_Samster

Bittensor's architecture ensures that the most important technology of the century—artificial intelligence—is built in a permissionless, fair, and open fashion. This isn't merely ideological positioning; it's structural insurance against the concentration risks that have plagued previous platform technologies.

The verdict: These five advantages compound over time. As more talent flows to the network, as more applications deploy permissionlessly, as competition intensifies, the quality gap between centralized and decentralized AI will widen rather than narrow. This structural superiority explains why sophisticated participants weight Bittensor exposure heavily in decentralized AI strategies—not as a speculative bet on a protocol, but as positioning for an inevitable architectural transition.

Further study: The complete case for decentralized AI infrastructure is documented in The Incentive Layer - A Bittensor Documentary, which provides detailed technical and philosophical context for the network's design principles.

Part II: The Pulse of the network—TAO, Alphas, and the Great Halving

To understand the health of the system, we must study its circulatory rules, known as tokenomics. This is the network's metabolic governor, incentivizing growth and enforcing scarcity.

The Root essence: TAO (τ)

The primary element is TAO (τ)—the network's universal solvent, its prima materia.

Core properties:

- Function: TAO is the core asset for security, governance, and the base collateral for all specialized economies

- Scarcity: Fixed, immutable supply of 21 million units, mirroring ancient digital scarcity principles

- Role: TAO acts as the "gold standard" of this digital world. Staking TAO on the Root Network (SN0) is participating in the consensus that governs the whole

The specialized distillates: Alpha (α) Tokens

If TAO is the root essence, the subnet "alpha" tokens are the specialized distillates. The Dynamic TAO (dTAO) model allows for their creation, establishing a two-tiered economy:

| Asset | Ticker | Function | How Value is Determined |

|---|---|---|---|

| Root Essence | TAO (τ) | The universal currency. Used for security, governance, and as the base-pair for all subnets. | The global market's belief in the entire Bittensor ecosystem. |

| Specialized Essence | Alpha (α) | A unique token for each subnet. Represents a stake in a specific AI commodity (e.g., ZK-proofs, compute, code). | The free market's (stakers') belief in the utility and future value of that one specific subnet. |

The alchemical exchange: When TAO is staked into a subnet, it is swapped for the specialized essence (Alpha). This is how the market votes with its capital. The more TAO that flows into a subnet's reserve, the higher its Alpha token price, and the more TAO emissions it attracts, creating a market-driven meritocracy.

The Great Transformation: Introduction to dynamic TAO (dTAO)

Dynamic TAO (dTAO) represents a fundamental evolution in Bittensor's economic design, introduced in February 2025 to address critical limitations in the original reward distribution system.

The problem it solved: Prior to dTAO, TAO emissions were allocated to subnets based on weights set by a small group of root validators on Subnet 0 (the Root Network). This created centralization, conflicts of interest, and inefficient capital allocation—validators often favored subnets they owned or had deals with, distorting incentives and reducing trust in the system.

The solution: dTAO shifts to a market-driven mechanism by introducing subnet-specific Alpha tokens. This creates the two-tiered economy described above, where TAO remains the network's base currency for security and governance, while Alpha tokens represent stakes in individual subnets' performance and utility.

Core purpose: Decentralize reward allocation, ensuring that TAO flows to subnets based on real market demand rather than validator decisions. This fosters competition, innovation, and a self-regulating system where high-utility subnets attract more capital and rewards.

⚡ dTAO Status: fully operational since February 2025

The Dynamic TAO (dTAO) emission system is fully operational and has been live since February 2025. This is not theoretical or speculative—it is the current, functioning reality of the Bittensor network.

📈 Current Network State (November 2025)

The emission percentages you see in the subnet tables are current, live allocations. They are not projections—they reflect the real-time, market-driven economy operating right now. The figures are as of the time of writting and can and will change over time.

| Timeline Event | Date | Status & Impact |

|---|---|---|

| dTAO Launch | February 2025 | Subnet Alpha tokens and liquidity pools went live. Market-driven emissions began. |

| Current Phase | June - November 2025 | Subnet-driven economy is fully mature. Root staking declining as planned. |

| First Halving Event | December 2025 | Emission rate halves from 7,200 to 3,600 TAO/day. Mechanism stays the same. |

What this means: When participants stake in a subnet, they immediately begin earning Alpha rewards at the current emission rate. The system is not "coming soon"—it is live, tested, and generating real economic data that informs allocation decisions.

The mechanics of the two-tiered economy

1. Liquidity pools: The alchemical vessels

Each subnet operates a constant product Automated Market Maker (AMM) pool (similar to Uniswap v2) pairing TAO and its Alpha token.

The invariant formula: The pool maintains a constant product:

- TAO reserves × Alpha reserves = k (a constant)

- Alpha price = TAO reserves ÷ Alpha reserves

Fair launch: Initial pool setup begins with a 1:1 TAO/Alpha ratio, ensuring no privileged early entry.

Example: If a pool has 1,000 TAO and 10 Alpha tokens, the Alpha price is 100 TAO per Alpha (or if TAO = $450, then Alpha = $45,000).

2. Staking and unstaking: the transmutation process

Staking TAO into a Subnet:

- Users stake TAO directly into a subnet's liquidity pool via Bittensor wallet (Chrome extension) or tools like Taostats.io or Backprop Finance

- This increases TAO reserves, decreases Alpha reserves (maintaining constant product), and raises the Alpha price

- In return, the staker receives Alpha tokens proportional to the value staked

- Benefits: Exposure to subnet growth; accrual of newly minted Alpha rewards

Example: Staking 1 TAO when Alpha price = $100 yields 0.01 Alpha tokens.

Unstaking:

- Swap Alpha back for TAO from the pool

- Decreases TAO reserves, increases Alpha reserves, lowering the Alpha price

- Slippage can occur in low-liquidity pools, affecting the amount received

Warning: Users should select subnets based on utility, community activity, and metrics like miner participation (check Discord, X, GitHub). Low liquidity can cause high volatility—prices can spike 100-200% on small trades.

3. Alpha token dynamics

Supply and minting:

- Each Alpha has a supply cap of 21 million per subnet (matching TAO)

- Follows the same halving schedule as TAO (first halving at 10.5 million supply)

- Initial minting rate: 2 Alpha per block (twice the TAO rate) to bootstrap liquidity

- This rate decreases as Alpha price rises, adjusting for demand

Critical property: Alpha tokens are not directly purchasable on external markets—they are acquired solely by staking TAO into the subnet's liquidity pool.

Distribution within subnets:

- Rewards distributed in Alpha tokens (not direct TAO)

- Typical split: 18% to subnet owners, 41% to miners, 41% to validators (varies by subnet governance)

- Miners and validators often auto-sell minted Alpha back into the pool for TAO, distributing value to stakers

⚙️ How emissions work (updated Nov 5th 2025)

Pre-Upgrade dTAO Mechanics (Prior to November 2025)

Prior to the November 2025 upgrade, dTAO created a two-tiered economy where Alpha tokens represented specialized stakes in subnet commodities. Liquidity pools (AMM-style TAO/Alpha pairs) enabled staking/unstaking, with emissions allocated proportionally to EMA-smoothed Alpha prices—a market-driven meritocracy rewarding demand. This system, while innovative, favored liquid pools, absorbed negative inflows without penalty, and reinforced price fixation, leading to biases toward speculation over sustained utility. Validators used a blended weight of Alpha holdings and Root TAO staking, shifting toward Alpha over time.

♨️ Dynamic TAO upgrade: net inflow EMA and root claim

The pulse of Bittensor’s economy continues to refine itself. As of November 5, 2025, Dynamic TAO has undergone a significant upgrade, shifting from EMA-based Alpha prices to net TAO inflows for emission allocation. This alchemical adjustment aims to foster sustainable growth by rewarding genuine network conviction over liquidity-driven biases. Combined with the new Root Claim feature, it empowers stakers with more control amid the approaching December 2025 halving.

In the “old” mechanism, TAO emissions favored subnets with higher EMA Alpha prices, leading to issues: bias toward liquid pools, absorption of negative inflows without penalty, and self-reinforcing price fixation. The upgrade introduces the Net TAO Inflow EMA—a smoothed average of staked minus unstaked TAO per block, weighted heavily on recent 86.8 days (86.5% influence) with a “look-back” to older inflows (13.5%). This prevents single-block volatility from disrupting emissions, creating stability by gradually adjusting to true inflow trends.

Subnets with positive net inflow EMAs receive proportional emissions; those with negative get none until inflows turn positive. Benefits include reduced manipulation, better alignment with sustainable activity, and a “Darwinian” filter for the halving—amplifying rewards for utility-driven subnets while starving speculative ones.

Additionally, Root Claim lets root stakers (SN0) choose how to claim dividends: “Swap” (default, convert Alpha to TAO) or “Keep” (hold Alpha from earning subnets). “Keep” reduces sell pressure on favored Alphas, offering exposure without risking staked TAO—ideal for conviction plays. Currently all-or-nothing, an upcoming update will enable per-subnet selection.

This evolution strengthens Bittensor’s meritocracy but heightens risks: Low-inflow subnets face emission cuts, potentially accelerating failures post-halving. As always, this is educational observation—verify on Taostats.io or official docs. Not financial advice; DYOR amid volatility.

This is the "market-driven meritocracy" operating in real-time.

For details, see Learn Bittensor’s guides: Net Inflow EMA and Root Claim or the following video by taostats.io.

Updated: market dynamics and risk considerations (post-dTAO upgrade)

With the November 2025 dTAO upgrade shifting emissions from EMA Alpha prices to Net TAO Inflow EMA, market dynamics have evolved to prioritize sustainable inflows over liquidity biases. This fosters merit-based growth but introduces new risks: Low-inflow subnets face zero emissions, accelerating "Darwinian" selection and potential failures, especially post-halving. Below, updated considerations reflect this shift—always verify on Taostats.io.

High FDV phenomenon:

- Early subnets still show high Fully Diluted Valuations due to low circulation (<0.4% supply initially).

- Upgrade mitigates by rewarding positive inflows, expected to normalize FDV as inflation and utility drive circulation—though speculative excess persists.

Alpha inflation pressure:

- High minting rates create downward price pressure from miner/validator selling for TAO.

- Now amplified by inflow requirements: Negative inflows halt emissions, forcing subnets to prove utility or face stagnation—aligning with long-term value but increasing short-term volatility.

Manipulation risks:

- Potential for artificial inflow boosting (e.g., coordinated staking) replaces old EMA gaming; mitigated by EMA smoothing and Root blending.

- Private validator-subnet deals remain possible, but upgrade's focus on net inflows adds scrutiny—cartels could exploit low-liquidity pools.

Volatility considerations:

- Low-liquidity pools vulnerable to swings; upgrade may exacerbate if inflows fluctuate wildly.

- Slippage severe on trades; requires precise position sizing/timing, especially with halving halving rewards.

Overall, the upgrade enhances stability for utility-driven subnets but heightens risks for speculative ones—50-80% drawdowns possible amid macro forces. This is educational; DYOR.

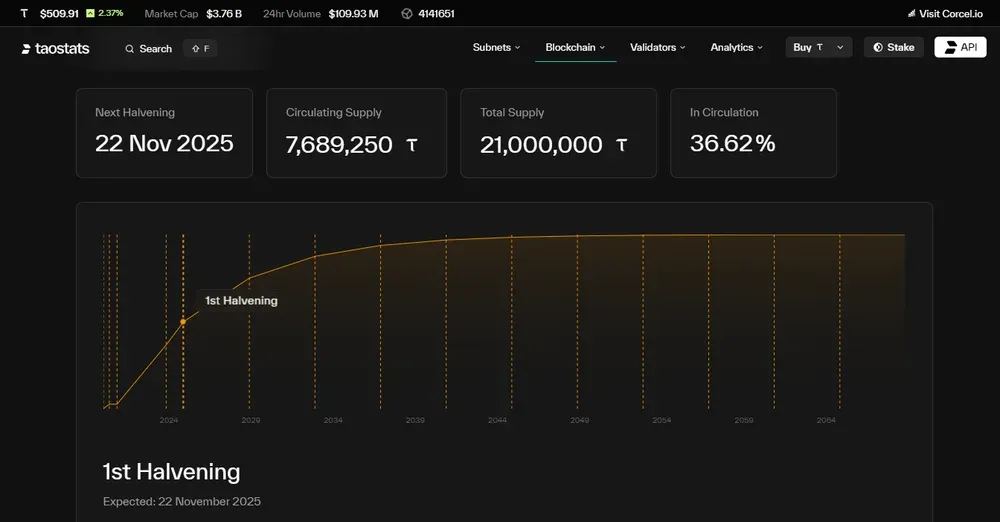

📉 The Great Halving: The Great Filter (December 2025)

This entire organism lives by a set, rhythmic pulse: the Halving.

Key mechanism details:

- Projected for December 2025

- Cuts the issuance of new TAO in half—from 7,200 per day to 3,600

- Simultaneously halves Alpha minting rates—from 2 Alpha per block to 1 Alpha per block

- Applies uniformly across all subnets at the same time

Critical understanding: The Halving does not mechanically change the emission formula or the subnet percentages. It only halves the absolute TAO per block (from 1 TAO → 0.5 TAO per block).

Updated: The Great Filter: Separating Utility from Speculation (Post-dTAO Upgrade)

The December 2025 halving—reducing daily emissions from ~7,200 to ~3,600 TAO—serves as Bittensor's "Great Filter," testing subnet resilience. The November 2025 dTAO upgrade intensifies this by allocating emissions solely to subnets with positive Net TAO Inflow EMA (smoothed staked minus unstaked TAO), zeroing out negative ones. This rewards organic utility demand (sustained inflows) over speculation, accelerating failures for weak subnets while concentrating rewards in strong ones—a zero-sum Darwinian shift.

Pre-upgrade, EMA Alpha prices drove allocations, enabling liquidity biases; now, inflows prioritize genuine conviction, aligning with halving pressures.

| Subnet Type | Pre-Halving Strategy | Post-Halving/Upgrade Outcome | Emission % Result |

|---|---|---|---|

| Strong Utility (e.g., Chutes, Affine, Proprietary Trading) | Real users + confident long-term stakers | Positive inflows maintain/increase; Alpha price holds as weak competitors fade | Maintains or Gains Share |

| Moderate Utility (e.g., established but competitive) | Mix of rewards-chasers and believers | Some outflows, but core inflows sustain; Root Claim aids retention | Slight Decline in Share |

| Weak/Speculative (e.g., niche projects, unclear value prop) | Primarily rewards-driven stakers | Negative inflows halt emissions; no demand replaces fleeing stakers; Alpha collapses | Drops Dramatically or Dies |

The zero-sum reality: 100% emissions concentrate in resilient subnets, amplified by the upgrade's inflow filter—utility wins, speculation loses.

Strategic considerations for participants:

- High-emission subnets show current market validation; post-upgrade, monitor inflows for sustained strength.

- Root Claim feature: Choose "Keep" Alpha dividends to reduce sell pressure, boosting inflows for favored subnets—ideal for conviction but adds complexity.

Warning signs to watch for:

- Negative/declining inflows (zero emissions risk)

- Alpha price dropping faster than peers

- Miner counts falling below critical mass

- Stagnant user activity or development (GitHub/Discord/X)

Opportunity signs to watch for:

- Positive/growing inflows (emission gains)

- Enterprise partnerships or feature launches

- Increasing TVL and miner competition

- Root Claim adoption reducing Alpha sell-offs

This filter, enhanced by the upgrade, heightens volatility—position as venture bets. Educational only; DYOR via Taostats.

The Alchemist's observation: The December 2025 Halving represents the first major test of which AI commodities have real market demand versus which were sustained purely by high inflation rates. Allocation decisions made in advance of this event will determine whether participants capture value from resilient subnets or experience losses from subnets that fail the utility test.

Part III: Map of the Crucibles—The subnet ecosystem

To navigate the Subnet ecosystem, this compendium maintains a map of the major categories and key players, ranked by the market's current conviction (Alpha Token Market Cap). As already explained the emissions are dynamic and will change and the figures presented are as of early November 2025. The idea is not to exhaust all 128+ subnets but to present a few. Always DYOR and look for changing emissions, subnet developments and new participants:

Compute / Hardware Infrastructure

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Datura (SN51) / lium.io | Decentralized GPU compute, hardware resource sharing | ≈ $71.27 Million USD | Datura AI / lium.io |

| NI Compute (SN27) | Decentralized Compute Market (GPU as a Service) | ≈ $3.38 Million USD | Neural Internet |

Core AI / Agent Reasoning

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Gradients (SN56) | AI Model Training, accessible distributed training platform | ≈ $39.42 Million USD | Rayon Labs |

| Templar (SN3) | Distributed, permissionless AI model training | ≈ $32.50 Million USD | Templar Team |

| Affine (SN120) | Infrastructure layer, connecting and composing subnets for AI inference | ≈ $27.57 Million USD | Affine Team |

| Apex (SN1) | Competitive AI agents and general-purpose intelligence | ≈ $12.40 Million USD | Opentensor Foundation / Macrocosmos |

Data Scraping / Indexing

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Hone (SN5) / OpenKaito | Decentralized search engine indexing and summarization | ≈ $29.54 Million USD | Kaito |

| Data Universe (SN13) | Decentralized data collection, storage, and analysis | ≈ $10.27 Million USD | MacrocosmosAI |

Decentralized Finance (DeFi) / Trading

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Proprietary Trading Network (SN8) | AI-driven trading strategies, financial predictions | ≈ $47.39 Million USD | Taoshi |

| Alpha Trader Exchange (ATX) (SN63) | Financial data analysis and prediction signals | ≈ $15.20 Million USD | Quantum Innovate |

Large Language Models (LLM) / Text Generation

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Chutes (SN64) | High-quality text/data generation, Serverless AI compute | ≈ $109.56 Million USD | Rayon Labs |

| Ridges AI (SN62) | High-quality text inference, specialized coding agents | ≈ $113.85 Million USD | RidgesAI |

Multi-Modal / Media Generation

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Targon (SN4) | Multi-modal AI systems (Text, Image, Audio, Video) | ≈ $56.34 Million USD | Manifold Inc |

| Nineteen (SN19) | Image Generation and Reasoning | Emerging/Lower | Rayon Labs |

Zero-Knowledge Proofs (ZK) / Verifiable AI

| Subnet (SN ID) | Focus/Digital Commodity | Approx. Market Cap (Alpha Token) | Developer Team |

|---|---|---|---|

| Omron (SN2) | Zero-Knowledge Proof-of-Inference (zk-ML) | ≈ $5.60 Million USD | Omron (Inference Labs) |

| Apollo ZKP (SN47) | Permissionless ZK prover market, general-purpose ZKP | Emerging/Lower | Apollo ZKP |

Part IV: A framework for allocation—theoretical considerations (Post-dTAO ppgrade)

The dTAO upgrade and impending halving demand a refined allocation approach: Prioritize subnets with positive net inflows for sustainable emissions, blending Root security with subnet growth. Obsolete EMA-based tiers are condensed—focus on inflow-driven resilience over price snapshots. This theoretical 2/3 Root / 1/3 Subnet framework (variants below) mitigates risks but remains venture-style: Adjust for inflows, as negative ones zero emissions. Educational only; DYOR—position with affordable capital.

Core Framework Principles (Updated)

- Root (SN0, 2/3 allocation): Provides governance/security; stable amid upgrade/halving—claim dividends via "Keep" for Alpha exposure without TAO risk.

- Subnets (1/3 allocation): Diversify by inflow tiers (post-upgrade: 50% Tier 1 >6% emissions/strong inflows like Chutes; 30% Tier 2 3-6% like Affine; 15% Tier 3 1-3%; 5% Tier 4 <1%).

- Variants: Conservative (75/25, inflow-stable focus); Balanced (65/35); Aggressive (50/50, high-inflow bets); Ultra-Aggressive (30/70, speculative inflows).

| Variant | Root % | Subnet % | Tier Breakdown (Subnet Portion) | Post-Upgrade Notes |

|---|---|---|---|---|

| Conservative | 75% | 25% | 70% Tier 1, 20% Tier 2, 10% Tier 3, 0% Tier 4 | Emphasize positive inflows. |

| Balanced | 65% | 35% | 50% Tier 1, 30% Tier 2, 15% Tier 3, 5% Tier 4 | Monitor inflow EMA. |

| Aggressive | 50% | 50% | 40% Tier 1, 30% Tier 2, 20% Tier 3, 10% Tier 4 | High reward/risk; inflows amplify gains but zero emissions on laggards. |

| Ultra-Aggressive | 30% | 70% | 30% Tier 1, 30% Tier 2, 25% Tier 3, 15% Tier 4 | Speculative; future utility critical—avoid unless good understagin of the projects |

Allocations once favored price liquidity; now, net inflows ensure utility-driven sustainability. This framework assumes diversification across 5-10 subnets; avoid concentration. Risks heightened: Inflow volatility may cut emissions abruptly. Not advice; consult professionals. Post-dTAO upgrade, prioritize subnets with positive net inflows for sustainable yields.

Part V: Risks —The Alchemist's warning: known hazards in the crucible

Every alchemical experiment carries risk. The wise practitioner acknowledges the volatile nature of the elements.

As of November 3, 2025, TAO trades at approximately $450, with a circulating market cap of ~$4.0-4.2 billion (ranked #30-40 globally). This valuation reflects ongoing hype from the upcoming December halving and institutional products like Europe's staked TAO ETP. However, such price volatility—including 200% year-to-date swings—highlights fundamental vulnerabilities where market enthusiasm may significantly outpace underlying utility.

The following risks demand careful consideration before committing capital to the Bittensor ecosystem:

Price volatility and market dynamics

Extreme price swings characterize TAO's trading behavior:

- Monthly volatility often exceeds 50%, with thin liquidity exacerbating rapid drops

- Historical patterns suggest potential 50-80% corrections in bear markets or post-halving if demand fails to materialize

- Hype-driven rallies around events like the December 2025 halving can create overbought conditions (RSI ~75), triggering sharp reversals when sentiment shifts

Subnet Alpha token volatility compounds these risks:

- Many Alpha pools contain extremely low liquidity (e.g., only 332 TAO in certain subnets)

- Small trades or reward dumps can cause dramatic price collapses

- Miner and validator auto-selling of Alpha rewards creates constant downward pressure

- Cascading liquidations possible when multiple subnet positions correlate negatively

Market manipulation concerns:

- Low liquidity enables whale manipulation

- Coordinated pump-and-dump schemes targeting specific subnets

- Information asymmetry between subnet insiders and external stakers

Valuation concerns and fundamental disconnect

Current valuations rest on narrative rather than revenue:

- $10B+ fully diluted valuation (FDV) is driven by AI/crypto convergence hype rather than demonstrated commercial traction

- Comparable to "zombie chains" like Cardano in market cap, but with far less proven real-world impact

- No clear path to revenue generation that justifies current multiples

Post-halving supply dynamics create uncertain outcomes:

- Supply cut from 7,200 to 3,600 TAO/day aims to create scarcity

- However, if subnet growth and utility adoption stall, valuations could collapse rapidly

- Price predictions vary wildly ($2,336-4,445 by 2040), all hinging on unproven long-term demand

Institutional hype versus economic reality:

- Products like Grayscale Trust and European ETPs inflate prices short-term

- Economic exploits, security failures, or utility disappointments could trigger institutional repricing

- Retail FOMO during halving period may create unsustainable price levels

Adoption challenges and utility limitations

Limited real-world use cases beyond crypto-native applications:

- Despite 128+ active subnets, most serve niche AI applications with minimal mainstream adoption

- Centralized alternatives (ChatGPT, Claude, Midjourney) remain faster, cheaper, and more user-friendly

- Decentralization introduces latency and complexity that "ruins" user experience for non-ideological users

High staking ratio creates liquidity constraints:

- ~80% of TAO staked reduces tradable supply but may deter new entrants

- Illiquidity premium may evaporate if unlock events or sentiment shifts trigger mass unstaking

Subnet quality and sustainability concerns:

- Subnet deregistration and burning mechanisms enforce "Darwinian selection"

- However, too many subnet failures risk ecosystem fragmentation and loss of confidence

- "Winner-take-all" dynamics where top subnets capture 70%+ of emissions may stifle broader innovation

Dependence on community and miner participation:

- Network effects require sustained contributor engagement

- Economic downturns or opportunity cost changes could reduce miner/validator quality

- Mismatches between required technical expertise and participant skill levels

Competitive pressures and market position

David versus Goliath dynamics in AI infrastructure:

- OpenAI valued at $157B, Google, Nvidia (controlling 70-90% of GPUs) possess overwhelming resource advantages

- Centralized competitors can move faster, attract top talent with traditional compensation, and leverage existing distribution

- Data moats and proprietary model advantages remain with incumbents

Intra-DeFi competition fragments the decentralized AI space:

- Fetch.ai, SingularityNET, Akash Network, and other DeAI protocols compete for similar use cases

- If centralized firms successfully integrate blockchain elements, Bittensor's differentiation erodes

- Protocol wars could result in capital dispersion rather than network effect consolidation

Subnet concentration risks:

- Top-performing subnets capturing majority of emissions creates centralization

- New subnet launches face steep barriers to gaining meaningful allocation

- Innovation may concentrate in established subnets rather than enabling diverse experimentation

Regulatory uncertainty and compliance risks

AI-specific regulations pose operational challenges:

- EU AI Act and similar frameworks may impose strict requirements on decentralized AI systems

- Data privacy, energy consumption, and model safety concerns invite regulatory scrutiny

- Global operations become complicated when jurisdictions have conflicting requirements

Evolving cryptocurrency regulations:

- While SEC clarity on TAO is currently positive, rules can change

- Subnet Alpha tokens may face classification challenges as securities

- Exchange listings for subnet tokens could invite additional oversight

Geopolitical and sovereignty risks:

- Nation-state "sovereign AI" initiatives may ban permissionless networks viewed as bypassing controls

- Export controls on AI technology could restrict participation in certain regions

- Censorship-resistant properties may attract regulatory hostility

Technical, security, and centralization Risks

Governance centralization concerns:

- Opentensor Foundation's central role creates single points of failure

- Historical security exploits and operational issues persist in network history

- Validator cartels or collusion could undermine decentralization promises

Technical scaling and implementation challenges:

- Scalability limitations as network grows

- dTAO mechanism bugs or economic exploits remain possible

- AI model integration vulnerabilities (prompt injection, model poisoning, adversarial attacks)

- Halving may amplify centralization among large stakers who can weather reduced rewards

Smart contract and protocol risks:

- Liquidity pool mechanics subject to front-running and sandwich attacks

- Emission allocation algorithms could contain exploitable edge cases

- Upgrade risks during major protocol changes (like dTAO implementation)

Infrastructure dependencies:

- Reliance on external data feeds and oracles

- Cloud provider dependencies for many miners despite decentralization ethos

- Network partition risks during internet disruptions

The Alchemist's synthesis

These risks are not merely theoretical—they represent real forces that could substantially diminish or destroy capital allocated to the Bittensor ecosystem. The December 2025 halving will serve as a critical test: either utility adoption accelerates to justify current valuations, or speculative excess unwinds dramatically.

Risk-adjusted perspective: Sophisticated participants may choose to maintain exposure despite these hazards if they believe the potential upside from successful decentralized AI infrastructure justifies calculated risk. However, position sizing must account for the realistic possibility of 50-80% drawdowns from current levels. This is not an asset class suitable for capital that cannot tolerate extreme volatility.

The theoretical 2/3 Root / 1/3 Subnet allocation framework provides some risk mitigation by maintaining secure foundation exposure while limiting frontier risk, but all Bittensor positions should be sized as venture-style bets rather than core portfolio holdings.

Part VI: Resources and live data

For real-time subnet metrics, Alpha prices, TAO emissions, and liquidity pool data, consult these authoritative sources:

- Taostats.io - Comprehensive subnet analytics, staking interface, and live emission percentages

- Backprop Finance - Alternative staking platform with portfolio tracking

- Official Bittensor Documentation - Technical specifications and governance updates

- Subnet Discord/X Communities - Developer activity, roadmaps, and real-time community sentiment

- GitHub Repositories - Codebase activity and miner/validator participation metrics

Critical for live monitoring: The emission percentages shown in this document (Chutes 7.84%, Affine 5.27%, etc.) reflect November 2025 snapshots. These percentages change continuously based on Alpha price movements and market activity. Always verify current allocations on Taostats.io before making allocation decisions.

What to track on Taostats.io:

- Current emission % for each subnet (updates every block)

- Alpha price trends (7-day, 30-day charts)

- Total Value Locked (TVL) in subnet pools

- Miner and validator counts (network health indicators)

- Daily/weekly emission flow (actual TAO distributed)

The dTAO economy is highly dynamic. Alpha prices, emission allocations, and APRs change continuously based on market activity. The December 2025 Halving will create significant volatility—monitoring real-time data becomes even more critical during and after this event.

Part VII: Yuma-backed subnets: High-risk bets on early-stage innovation

Yuma accelerates decentralized AI, funding early Bittensor subnets with a $10M DCG anchor and $750k from Nasdaq-listed TAO Synergies (TAOX). All listed are Yuma-backed; Tier 3-4 risks: low-utility, pre-product, deregistration could happen and 50-80% drawdowns post-halving might occur. Independent dev teams innovate niches, but success depends on utility—not backing alone.

Key Players and Relationships

- TAO Synergies (TAOX): Nasdaq-listed; funds Yuma subnets for Bittensor growth.

- Yuma: DCG subsidiary; channels capital to dev teams despite early risks.

- Dev Teams: Groups like Sturdy Finance; some with external VCs (e.g., Pantera/YC for Sturdy).

- VCs: Provide runway (e.g., DCG anchors Yuma); bet on future utility.

Observation only: DYOR; data November 5, 2025—verify Taostats.io/CoinGecko. Post-dTAO upgrade, inflows (not emissions) drive allocations.

Below, all subnets in one table with market caps (Alpha tokens) and utility statements (extremely speculative potential).

| SN | Category | Name | Team/Handle | Market Cap (USD) | Utility Statement |

|---|---|---|---|---|---|

| SN44 | Core AI / Agent Reasoning | Score | @webuildscore | $19.36M | AI for sports vision/prediction from footage; enables betting/training insights. |

| SN10 | Decentralized Finance (DeFi) / Trading | Swap | @SturdyFinance | $7.09M | Cross-chain DeFi for subnet tokens; incentivizes liquidity with AI allocations. |

| SN54 | Core AI / Agent Reasoning | Yanez MIID | @yanez__ai | $4.62M | Synthetic identities for financial crime testing; enhances fraud detection. |

| SN6 | Multi-Modal / Media Generation | Infinite Games | @Playinfgames | $4.42M | Decentralized event forecasting; incentivizes predictions via AI agents. |

| SN61 | Core AI / Agent Reasoning | RedTeam | @redteam | $4.03M | Decentralized cybersecurity R&D via ethical hacking; aids audits/bug bounties. |

| SN42 | Compute / Hardware Infrastructure | Gopher | @gopher_ai | $3.57M | Real-time data processing for AI models; trusted execution environments. |

| SN60 | Zero-Knowledge Proofs (ZK) / Verifiable AI | Bitsec | @bitsecai | $2.74M | AI-powered code vulnerability detection; assists smart contract audits. |

| SN58 | Multi-Modal / Media Generation | Dippy Speech | @dippy_ai | $2.51M | Empathetic speech for AI companions; enables lifelike voice interactions. |

| SN59 | Large Language Models (LLM) / Text Generation | Babelbit | @babelbit | $2.45M | Real-time speech translation; aims to surpass centralized tools. |

| SN15 | Decentralized Finance (DeFi) / Trading | BitQuant | @BitQuantAI | $2.23M | Decentralized AI quant for crypto; on-demand trading signals/DeFi intelligence. |

| SN70 | Core AI / Agent Reasoning | Vericore | @dFusionAI | $2.16M | Semantic fact-checking for text/audio/video; incentive-aligned audits. |

| SN96 | Core AI / Agent Reasoning | FLock OFF | @flock_off_sn96 | $1.98M | Permissionless federated learning on edge devices; crowdsources datasets. |

| SN55 | Core AI / Agent Reasoning | Precog | @CM_Precog | $1.67M | High-precision Bitcoin price forecasting; outperforms holding in simulations. |

The Alchemist's Warning: Yuma-Backed Subnets Edition

Early stage means very high risks; teams like Sturdy (Pantera/YC) have firepower, but value needs utility. Speculative: Volatile, illiquid, collapse-prone. Educational only—consult professionals and DYOR.

Legal Disclaimers and Disclosures

From the Apothecary's Desk

The thoughts, mental models, and observations shared here represent educational analysis of the Bittensor network's technical and economic mechanisms. This is not financial advice or investment recommendations. The Sagix Apothecary is a chronicle of network observation and analysis, not a prescription for investment decisions.

This is an educational compendium, not a directive. The frameworks and observations presented are for study and understanding, not replication. All digital commodities, tokens, and protocols mentioned carry immense and inherent risk. Participants must conduct their own research and due diligence.

The future is unwritten. Seek your own counsel.

Educational Purpose Statement

Educational Purpose Only: This content is provided exclusively for educational and research purposes. It should not be construed as investment advice, financial planning guidance, or official economic analysis. Any allocation strategies or portfolio discussions are presented as documentation of our own approach, not recommendations for action.

No Professional Relationship: This content does not create any professional, advisory, fiduciary, or client relationship between the reader and Sagix Apothecary, its authors, or affiliated entities. Readers seeking financial, investment, or legal guidance should consult qualified professionals licensed in their jurisdiction.

Risk Warnings

Investment Risk Warning: Cryptocurrency investments, particularly in emerging AI infrastructure networks like Bittensor, carry substantial risk of loss. The tokens, subnets, and allocation strategies discussed involve high volatility, technical complexity, and regulatory uncertainty. As detailed in "The Alchemist's Warning" section above, TAO and Alpha tokens can experience 50-80% drawdowns, subnet failures, security exploits, and valuation disconnects from fundamentals. Past performance does not guarantee future results.

Specific Bittensor Risks: This network faces unique hazards including extreme price volatility (50%+ monthly), low liquidity in subnet Alpha pools, competitive pressures from well-funded centralized AI companies, adoption challenges, regulatory uncertainty, and technical implementation risks. The December 2025 halving represents a critical test that could result in dramatic price appreciation or collapse depending on utility adoption.

Position Sizing Imperative: All Bittensor positions should be sized as venture-style bets with capital you can afford to lose entirely. The theoretical 2/3 Root / 1/3 Subnet allocation framework provides some risk mitigation but does not eliminate the possibility of substantial losses.

Technical Risk: Bittensor network protocols, subnet mechanisms, and tokenomics are subject to change through governance decisions, network upgrades, or unforeseen technical issues. The dTAO mechanism, while innovative, remains relatively untested at scale and may contain exploitable vulnerabilities.

Market Risk: Alpha token valuations, subnet rankings, and TAO emissions are highly dynamic and subject to rapid change based on market sentiment, technological developments, and competitive dynamics. Current valuations may significantly exceed justified levels based on demonstrated utility.

Accuracy Limitations

Accuracy Limitations: While efforts have been made to ensure accuracy of subnet data, market capitalizations, and emission percentages, this information represents a snapshot in time and may not reflect current conditions. Readers should verify all data independently through official Bittensor network sources.

Liability Protections: The authors, publishers, and Sagix Apothecary assume no responsibility for errors, omissions, or consequences arising from the use of this information. Users assume full responsibility for any decisions or actions taken based on this content.

Intellectual Property

Original Analysis: While this content draws upon publicly available information about the Bittensor network, the synthesis, thematic presentation, and allocation philosophy represent original analytical work by Sagix Apothecary.

Content Usage: Readers may reference this content for educational purposes with proper attribution. Commercial use, redistribution, or republication requires express written permission from Sagix Apothecary.

Publication Information

Last Updated: November 5, 2025

Series: The Sagix Apothecary

Publisher: The Genesis Address LLC

Website: Sagix.io

This document may be updated periodically to reflect network changes, new subnet developments, or refinements to allocation frameworks. Readers should verify they are accessing the most current version.